8 Simple Steps To Get Out Of Debt FAST

| 1. Know Your Debts |

| Make a strong coffee and block out an hour of your day to get all your paperwork together and fill in the debt tracker. This might not be the most exciting hour of your life but you will thank yourself for it, honestly! Its really important to know exactly where you stand with everything. Don’t forget to add in any savings you might have too. |

| 2. Check Your Credit Score |

| Check your credit score – make sure that all the information they hold about you is correct, you will have to get any errors corrected before you can move on. Do this regularly too as getting this fixed might not be a quick fix. |

| 3. Check Your Utilities |

| Are you out of contract with your gas, phones, water, electricity etc.? Could you get a better deal elsewhere? Check out using a cashback site for this too, you could get paid for switching providers as well as saving money on your monthly bills. |

| 4. Identify the Quick Fixes |

| What can you do right now? Do you have saving that are paying you far less interest than your credit cards are costing you? Consider paying these off now! Do you have any empty credit cards that might be willing to offer you a low rate if you ask them? Look at all your outgoings to see if there is anything you can either cancel or get cheaper elsewhere. |

| 5. Get Cheaper Credit |

| Before you panic about how much you owe and jump into a consolidation loan, see if you can switch some of your existing credit to lower rates. Find the most expensive of your current debts (by annual interest rate) and move these over to the cheaper credit vehicles. |

| 6. Sell Some Stuff! |

| We all have lots of unwanted items in our homes. If you want to pay off debts ASAP, look at selling some of them through eBay, amazon marketplace, Craig’s list, Facebook etc. Even downgrading your car or house might be an option if you are seriously committed! |

| 7. Track Your Spending |

| Using simple excel spreadsheets or if you are more tech savvy you could use an app that helps you track and manage your spend. Doing this will help you to see where most of your money is going and help you to get a handle on it. Tracking spending alongside your debt also shows you how well you are doing paying down your debts. |

| 8. Get Some Help |

| If you are completely overwhelmed with it all and really can’t face dealing with it, that’s totally fine, but for your own health and wellbeing, and to enable you to fix your situation, you probably do need to get some support. This could be family, friends, debt help charities or counselling services. This might be of particular help (and should maybe move to number 1) if you have a spending habit that’s out of control. Get your head in the right place and everything else will follow. |

Print it off and stick it on your fridge or noticeboard and make it an integral part of your best debt action plan.

You might need to revisit a few of them over the coming months but it’s a handy reminder and will help you stay on track.

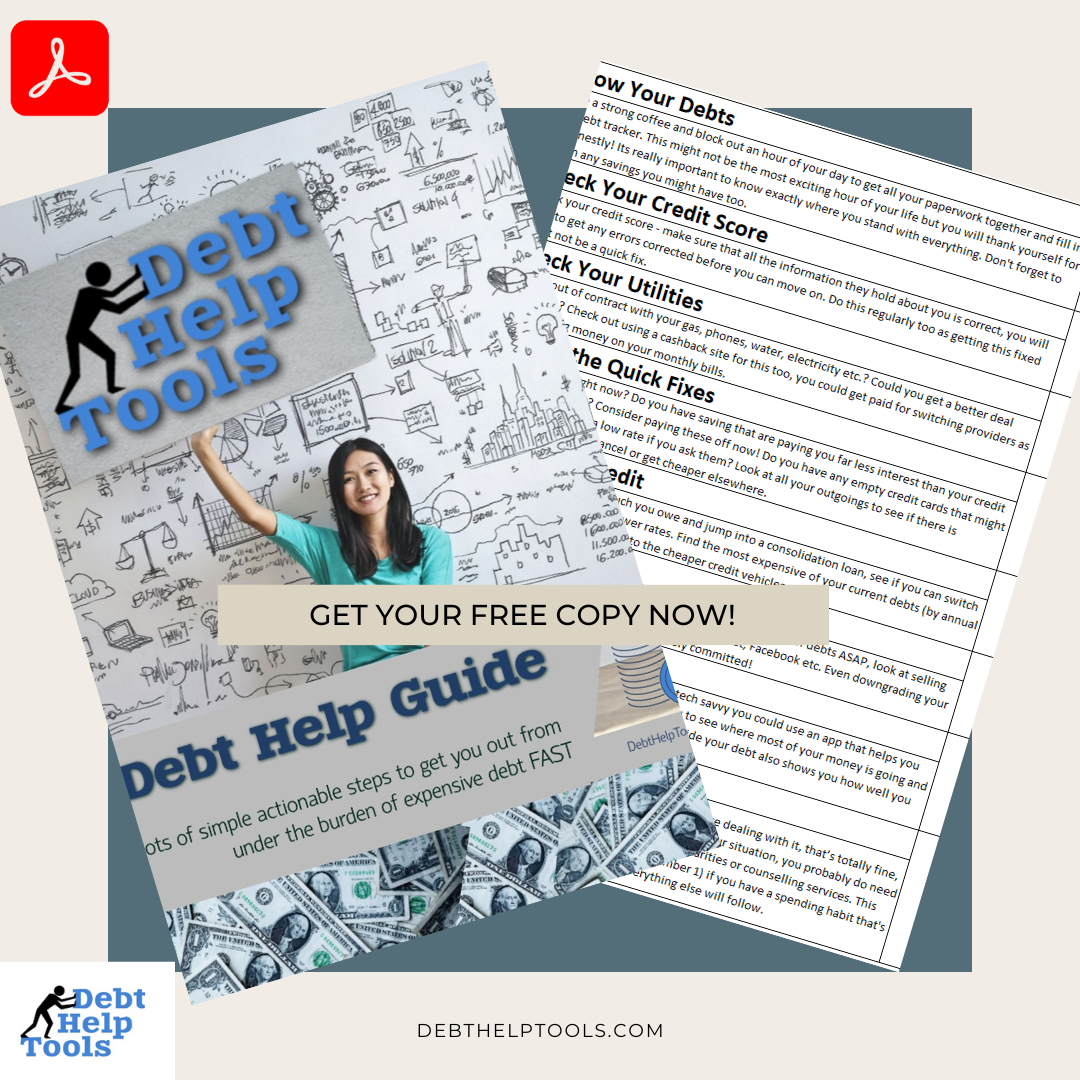

If you want something more comprehensive, take a look at the 10 page pdf guide that comes FREE with your checklist, it’s got a super simple 4 stage plan so you can find the right steps for you to take where ever you are on your journey.