Mortgage Type Comparison: Case Study

Whether you are looking for your first mortgage or you’re finally getting around to organising a refinancing deal, this very very simple case study might give you a few ideas about what it could mean for your finances when you are inevitably presented with a range of different options by your bank or broker.

Let’s look at a basic 75% mortgage over 25 years. So if you are buying a house for £100k and you want to borrow £75k over 25 years (I know its cheap house, but I like simple maths) so your loan to value or LTV is 75% and your deposit is £25k. With me so far?

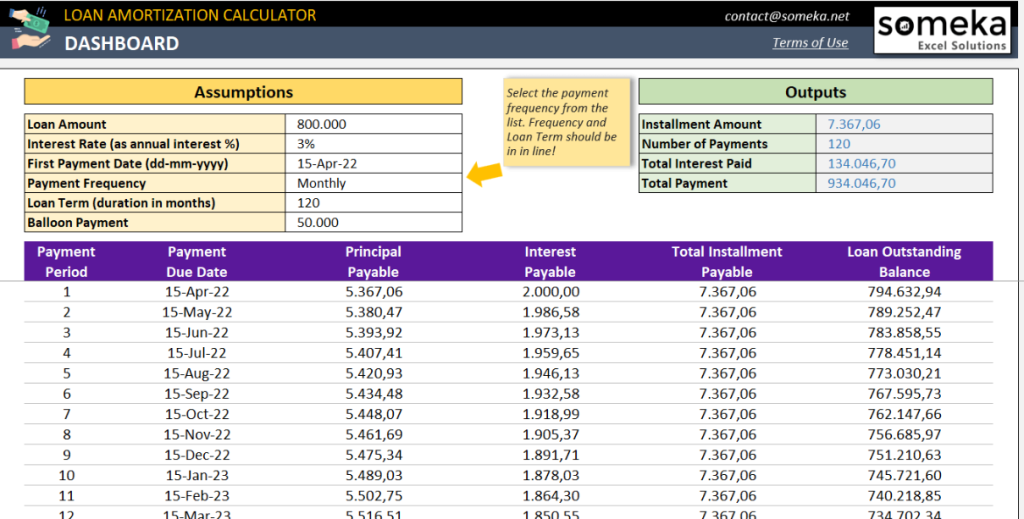

[The calculator used for the following tables can be found here if you want to put your own numbers in: https://www.moneysavingexpert.com/mortgages/mortgage-rate-calculator#results]

I’m based in the UK so there may be some aspects of the US market that I am not familiar with when it comes to the types of mortgages that are available, but I’m pretty sure that you’ll be able to see some similarities with how it works in the UK and hopefully get some ah-ha moments from the numbers.

Mortgage Option 1 – Repayment Mortgage

If you expect to pay 2.5% for the mortgage, you can put these numbers into pretty much any online calculate, and it will tell you that:

| Per month, your mortgage payment (Assuming your interest rate stays the same): | £337 |

| Total you’ll repay over full term (Includes mortgage debt, £75,000 + total interest £25,951) | £100,951 |

| Capital repaid | £75,000 |

| Total Interest | £25,951 |

You may at this point wish to live on rice and beans for the next ten years to pay the damn thing off which would of course [by conventional wisdom] would be an admiral thing to do, but maybe not entirely practical. Besides, if you manage your debt well, you could put that money to much better use.

Mortgage Option 2 – Interest Only Mortgages

Option 1 is for a repayment mortgage, however if you decided to just pay the interest it could look like this:

| Per month, you repay (Assuming your interest rate stays the same) | £156 |

| Total you’ll repay over full term (Includes mortgage debt, £75,000 + total interest £46,896) | £121,896 |

| Capital repaid | £75,000 |

| total interest | £46,896 |

So just paying the interest means that the house has cost you (£46,896 – £25,951) £20,945 more in interest so you’d think that sticking with a repayment would be better yes?

Well if you put the difference in your monthly repayment every month i.e. your repayment monthly cost less your interest only monthly cost (£337-£156 = £181) into an investment account at 5% (Yes, I admit that these are few and far between these days, but for the sake of argument lets go with it for now…)

| Amount paid into savings | £181 |

| Your Contribution | £54,300 |

| Investment Growth | £52,149 |

| Total Savings After 25 Years | £106,449 |

| At the end of 25 Years you pay off the origianl mortgage | -£75,000 |

| Cash Left Over!! | £31,449 |

You have paid almost £21K more interest on the mortgage BUT you earned £52,149 on your savings for exactly the same monthly outlay.

(CLICK HERE to use the online calculator that I used for these numbers)

Are you confused yet?

Another choice you would have with the option 2 route, especially if you wanted to retire earlier or just decrease your outgoing for lifestyle reasons would be to pay off the balance as soon as you had saved enough up which would again be much faster than just over paying the mortgage.

I have made a huge assumption here that your mortgage interest is substantially LESS than money you can get through “safe” investments, where this is not the case i.e. your mortgage rate is far higher than and savings or investments that you are willing to open, or you don’t want to take any kind of risk at all, just pay the mortgage off along with any other debt asap and skip to the next section.

The opposite also applies, if you have a slightly higher appetite for risk, you could (WITH GOOD PROFESSIONAL ADVISE!!) use an investment vehicle that returns more than 5% and you’d really be quid’s in. Just be very careful, this is not your money you are playing with, it’s the banks and it’s your home at risk.

Another point to note here is that if your house is worth more than £100k and you have an amazing credit rating so can get a mortgage at a wonderfully low rate, and you are comfortable with this higher level of risk, you could make a lot of money investing this capital somewhere else. This might be of particular interest to you if you have paid off your house or have a low “loan to Value” (LTV) i.e. you own a large amount of your house. Just look at all that capital that’s sitting in your house doing nothing; it could be working for you!

I MUST stress again here that this is by no means financial advice and I urge you to see a professional advisor if you are considering doing anything with your mortgage and investments

Something else you might want to consider is that if you don’t intend to pay off your mortgage until you retire is using your pension or some other pre tax savings vehicle to save this extra money to pay off your mortgage, that way you are saving BEFORE tax and can rack up even more interest.

A pension’s advisor will help you with how you might do this as your age and the limit on pension contributions as well as a number of other personal factors will impact your options.

Don’t forget that the value of your house will be going up (hopefully) so every few years when you buy a new mortgage product, you will have a new higher total value and therefore a lower loan to value % i.e. 75k owed against a 100k house is of course 75% but when your house become worth £125k, your LTV becomes 60% which should get you a lower mortgage rate as you are of course reducing the risk that the lender is carrying because you own more of the house.

I have not addressed here the potential for interest rates to increase massively which could have a devastating impact all your carefully laid plans, nor have I factored in a property price crash, both of which, depending on what you read are almost always imminent and I’d be lying if I said I had any answers for you. Seriously did you think I did? If I had that kind of magic I’d be on a beach somewhere being served cocktails by a shirtless hunk instead of watching snow fall in my pyjamas and writing about mortgages!

Suffice to say – PLEASE do your research. There is never only one solution, there is only the best one for you at this point in your journey and that solution is likely to change as your circumstances and the economy changes, just stay open minded and well informed and put as many contingencies in place as you can so that you stay at least that one step ahead!

Option 3 – Mortgage Overpayments

Hopefully the above illustration shows how overpaying your mortgage is not always the best course of action to take.

If you over paid each month and took the mortgage over 15 years instead of 25 you’d drastically cut your interest payments (of course) so just to refresh your memory, the standard repayment mortgage over 25 years would have cost £337 per month and looked like this:

Per month, you repay (Assuming your interest rate stays the same): £337.00

Total you’ll repay over full term (Includes mortgage debt, £75,000 + total interest £25,951) £100,951

Capital repaid £75,000

Total interest £25,951

If you instead chose to make monthly contributions of £500 over 15 years you would shave almost £11k off your interest

REPAYMENT over 15 years instead of 25 (at 2.5% interest)

Per month, you repay (assuming your interest rate stays the same) £500

Total you’ll repay over full term £90,029

Capital repaid £75,000

Total interest £15,029

However; there is another option……

Option 4 – SHORT term interest-only mortgages

INTEREST ONLY over 15 years instead of 25 (at 2.5% interest)

Per month, you repay (assuming your interest rate stays the same) £156

Total you’ll repay over full term £103,138

Capital repaid £75,000

total interest £28,138

Additional interest paid by going interest only: £28,138 – £15,029 = £13,109

Invest the left over £344 over 15 years @ 5% 500-156 = 344 £344

Total savings after 15 years £91,470

Your contribution £61,920

Investment growth £29,550

capital owed -£75,000

£16,470

So; amount earned = £16,470, less the additional interest paid of £13,109 = £ 3,361

That’s £3.3k in your pocket (or a very decent holiday!) at the end of the 15 years for exactly the same monthly outlay of £500

The numbers used here are way below the average cost of a house in the UK at the time of writing (pre Brexit! and that pexy little pandemic thingy) but it should give an illustration of how you can balance your debt against your saving to MAKE money instead of just paying it out. Getting this right doesn’t cost you any more than you are already paying out but you finish the game in a far better position!

Mortgage Type Comparison Conclusion

so here we have looked at 3 simple ways to organise your mortgage: option 1 being the standard repayment type (interest & equity) which would include fixed rate or variable, option 2; Interest only and option 3 – throw everything you have at it and pay it off!

so how does it look when we put these options side by side?

| Description | Option1 | Option 2 | Option 3 | Option 4 |

| Total Monthly Payment | £337 | £337 | £500 | £500 |

| Term (years) | 25 | 25 | 15 | 15 |

| Monthly payment to a repayment mortgage @ 2.5% | £337 | £0 | £500 | £0 |

| Monthly payment to an interest only Mortgage @ 2.5% | £0 | £156 | £0 | £156 |

| Monthly payment to a savings / investment pot @ 5% return | £0 | £181 | £0 | £344 |

| Interest paid on mortgage | £25,951 | £46,896 | £15,029 | £28,138 |

| Balance of interest received from savings (after capital repaid) | £0 | £31,449 | £0 | £16,470 |

| Overall cost of the loan at the end of the term | £25,951 | £15,447 | £15,029 | £11,668 |

I know these numbers are REALLY simple and they do not take into account the many changes that occur both economically and personally over this vast amount of time. They also do not take any account of issues that might arise with the investment vehicle you chose to grow your money.

There are so many factors that can change depending on your personal situation, the amount of the loan, the life of the loan and of course the economy that we subsist within!

I’m not sure if you remember endowment policies? They were the thing to do in 70’s and 80’s but very few of them delivered on their promises, in fact most left people in a far worse situation than a standard repayment option. They were loosely based on this principle of interest only loans (mortgages) and investments but they included life insurance and were (are) provided by life assurance companies.

See the money advice service if you are in the UK for more information on this.

The other elephant in the room that has not been accounted for in these numbers is the tax due on your savings interest. This is way too complex and subjective to address here but if you are considering taking this mortgage restructure thing forward, you must be clear on how this could impact you in your particular circumstances before you set anything in motion.

I really like this you tube channel – she always talks so much sense! If you are in the UK, you might find it useful too.

Take away points are:

- Keep your mortgage interest low, by:

- Keeping the LTV balanced so that you get the best rates without tying up too much of your capital.

- Getting a new product every few years – never just let it run on, that’s potentially just throwing money away.

- Keeping your credit score high so that you can always get the best possible rates.

- Investing in a good mortgage broker to get you they best rates / terms available.

- Save as much as possible so that you can pay off the capital when you need to

- Use pre-tax savings or investment vehicles such as pensions where you can.

- Be clear about the TAX impact

- Get a really good financial advisor before you do anything serious, its complex stuff if you’re a novice and can be VERY costly if you get it wrong.

if you are in the US – this might be of more use to you…

If you are now ready to start plugging some of your own numbers into a spreadsheet to see how it might work for you, then you might want to look at these:

-

How to Withdraw Money from TopCashBack

How to Withdraw Money from TopCashBack Unlike some sites that limit what you can withdraw and how you can spend it – topcashback will actually just send you the cash – follow the simple steps below to get your cash BACK! What about the cashback you’ve earned? Your cashback earnings can take a little time…

-

Bad Credit and What You Can Do About It: A Helpful Guide for Financial Recovery

Bad Credit and What You Can Do About It: A Helpful Guide for Financial Recovery Bad credit can feel like a financial anchor, especially when trying to secure loans or credit cards. But what if you could turn things around? Dive into our comprehensive guide to understand the intricacies of bad credit and discover actionable…

-

How to Sell Digital Products on Etsy

How to Sell Digital Products on Etsy – And if it’s Worth it! Are you looking to sell digital products on Etsy? You’ve come to the right place. Etsy is a well-established online marketplace, making it the perfect platform for selling a wide variety of digital products. From printables and digital art to e-books and…