Psychological Reasons for Overspending & How To Break The Cycle

Breaking the cycle of overspending starts with understanding your unique money mindset and the psychology behind your spending habits.

By identifying the patterns and triggers that cause you to overspend, you can create strategies to improve your financial habits and stop spending money impulsively.

Prioritising emotional well-being and financial literacy is essential in establishing a healthier relationship with money, moving you towards improved financial well-being.

In today’s consumer-driven society, many find themselves trapped in the cycle of overspending. This not only leads to financial strain but also emotional and mental stress. But what drives this behaviour?

Let’s delve deeper into the psychology behind overspending and explore actionable steps to break free from this cycle.

Top 10 (Somewhat Amusing) Reasons Why People Overspend

- Retail Therapy: Because who needs a therapist’s couch when there’s a sale at your favourite store?

- Instant Gratification: “I want it, and I want it now!” – said every over spender ever.

- Keeping Up with the Kardashians, I Mean, Joneses: If they have a golden llama statue in their yard, why shouldn’t you?

- Financial Literacy? More Like Financial Glitteracy: Some of us missed that day in school when they taught how not to buy everything shiny.

- Impulse Purchases: “Look, a squirrel!”… and now I own squirrel-themed pyjamas.

- Sales and Discounts: Because buying something 50% off means you’ve saved money, right? (Even if you didn’t need it in the first place.)

- Credit Card Swipes: It’s like magic! Until the bill arrives.

- FOMO: Fear of Missing Out on that limited-edition, glow-in-the-dark garden gnome.

- Peer Pressure: “All my friends have pet llamas, so I should get one too!” (See point 3 about golden llama statues.)

- Lifestyle Inflation: Got a raise? Time to upgrade from instant noodles to gourmet pasta! (Or maybe a pet llama.)

Remember, while it’s fun to laugh at our quirks, understanding the reasons behind our spending can pave the way to a wallet that’s as full as our sense of humour!

Understanding Your Money Mindset to Stop Overspending

Every individual has a unique relationship with money, often referred to as their “money mindset.” This mindset is a culmination of beliefs, attitudes, and experiences that shape how one perceives and interacts with money.

- What is Your Money Mindset?

Your money mindset is a reflexion of various factors, including your upbringing, personal experiences, cultural background, and overall attitude towards finances. It’s the lens through which you view financial decisions, from spending and saving to investing.

Recognising and understanding this mindset is the first step towards making conscious and informed financial choices that align with your goals and values.

Your upbringing plays a significant role in shaping your money mindset.

The lessons and beliefs about money that you learnt from your parents or caregivers can have a lasting impact on your financial behaviours. For example, if you grew up in a family that emphasised frugality and saving, you may naturally adopt a similar mindset as an adult.

On the other hand, if you were raised in an environment where money was scarce and there was a constant struggle, you may develop a scarcity mindset, always fearing there won’t be enough.

Personal experiences also shape your money mindset.

Positive experiences, such as achieving financial goals or receiving a windfall, can foster a mindset of abundance and confidence in managing money. Conversely, negative experiences like a job loss or financial downturn can lead to a more cautious and fearful mindset.

Cultural background and societal influences also play a role in shaping your money mindset. Different cultures and communities have varying attitudes towards money, wealth, and consumerism.

For example, some cultures prioritise saving and investing, while others may prioritise immediate spending and material possessions. These cultural influences can shape your beliefs and attitudes about money, often subconsciously.

Your overall attitude towards finances, including your beliefs, values, and emotions, also contribute to your money mindset.

For example, if you have a positive attitude towards financial planning and believe in the power of budgeting and investing for the future, you’re likely to have a proactive and responsible money mindset. Conversely, if you have negative emotions like fear or anxiety around money, it can lead to a more passive and reactive money mindset.

Recognising and understanding your money mindset is crucial because it affects your financial decisions and behaviours.

By becoming aware of your beliefs and attitudes about money, you can challenge any negative or limiting thoughts and work towards developing a more positive and empowered mindset. This can help you make more conscious and informed financial choices that align with your goals and values, leading to better financial well-being.

How Does the Psychology of Debt Affect Spending?

Debt, for many, is a heavy burden that influences their daily decisions.

The psychology of debt can lead to feelings of entrapment, pushing individuals towards impulsive behaviour and emotional spending. This cycle can be self-perpetuating, with emotional spending leading to more debt, which in turn leads to more emotional spending.

The psychology of debt can have a profound impact on an individual’s spending habits. Here are a few key ways in which it can influence spending:

1. Feelings of Entitlement: When someone is burdened by a significant amount of debt, they may feel a sense of entitlement to spend. This is because they may believe they have already sacrificed enough or that they deserve some relief from the stress of debt. This mindset can lead to impulsive buying behaviours, often resulting in additional debt.

2. Emotional Spending as a Coping Mechanism: People often turn to spending money as a way to cope with negative emotions such as stress, anxiety, or depression. Retail therapy, for example, may provide a temporary escape or a fleeting sense of happiness. However, this behaviour can become a habitual response, causing individuals to spend beyond their means and accumulate more debt in the long run.

3. Self-Worth and Material Possessions: Some individuals use material possessions as a measure of their self-worth or success. They may feel the need to keep up with societal expectations, compare themselves to others, or demonstrate their status through material acquisitions. This psychological motivation can drive people to spend beyond their means and accumulate substantial debt.

4. Avoidance of Debt-Related Anxiety: The anxiety that accompanies debt can be overwhelming for many individuals. To alleviate this anxiety, some people engage in what is known as avoidant coping, where they avoid thinking about or confronting their financial situation. This can lead to avoidance of responsible financial behaviours like creating a budget or seeking professional help, instead opting for a bit of retail therapy that offers only temporary relief.

5. Future Discounting: Debt can create a sense of urgency or pressure to fulfil immediate desires or needs, often at the expense of long-term financial stability. This sense of urgency may cause individuals to prioritise instant gratification over saving money or making wise financial decisions, leading to more debt accumulation.

Breaking this cycle requires a shift in mindset and the development of healthier financial habits. Seeking professional financial guidance, creating a realistic budget, and focusing on long-term financial goals can help individuals overcome the psychological barriers associated with debt and regain control of their spending habits.

Why Do People Overspend?

The reasons for overspending are multifaceted. For some, it’s the allure of instant gratification, the thrill of a new purchase.

For others, it’s societal pressure, the need to “keep up with the Joneses.” Additionally, a lack of financial literacy can leave individuals ill-equipped to manage their finances effectively, leading to poor spending decisions.

Another reason for overspending is emotional spending. Many people use shopping as a way to cope with stress, anxiety, or other negative emotions. Retail therapy can provide temporary relief, but it often leads to unnecessary purchases and financial consequences in the long run.

Advertising and marketing also play a significant role in encouraging overspending. Companies strategically create advertisements to appeal to consumers’ desires and create a sense of urgency to make a purchase.

The constant bombardment of advertisements, both online and offline, can influence individuals to buy things they don’t necessarily need.

Easy access to credit and the availability of instalment plans also contribute to overspending. With credit cards and loans readily available, it is effortless for individuals to make purchases they can’t afford and delay the consequences of their compulsive spending. This can lead to accumulating debt and financial stress.

Peer influence is another factor that leads to overspending.

Seeing friends or colleagues with expensive possessions or engaging in lavish experiences can create a desire to match their lifestyle. Peer pressure can push individuals to spend beyond their means in an effort to fit in or be perceived as successful.

Ill considered decision-making and a lack of self-control can also contribute to overspending. Some individuals struggle with controlling their impulses and end up making impulsive purchases without considering the long-term consequences.

This lack of self-control can result in accumulating debt and financial instability.

In summary, the reasons for overspending include instant gratification, societal pressure, lack of financial literacy, emotional spending, advertising, easy access to credit, peer influence, impulsivity, and lack of self-control. Understanding these factors can help individuals make better financial decisions and avoid the pitfalls of overspending.

Identifying and Changing Financial Habits

Awareness is the first step towards change.

By identifying detrimental financial habits and understanding their root causes, one can begin the journey towards financial well-being. Here are some steps to identify and change financial habits:

1. Self-reflection: Take some time to reflect on your financial habits and analyse where you may be going wrong. Look for patterns or behaviours that are repeatedly leading to financial stress or hardship.

2. Track your expenses: Keep track of your spending for a month or two to identify areas where you may be overspending or spending impulsively. Use a budgeting app or a spreadsheet to record your expenses.

3. Analyse your spending patterns: Once you have tracked your expenses, review them to identify common spending categories and areas where you can cut back. Look for patterns such as unnecessary purchases, mindlessly buying stuff, or overspending on certain items.

4. Identify triggers: Understand the emotional or situational triggers that lead you to engage in detrimental financial habits. For example, you may overspend when feeling stressed, lonely, or bored.

5. Set realistic financial goals: Determine what you want to achieve financially in the short term and long term. Whether it’s paying off debt, saving for a down payment, or building an emergency fund, having clear goals will help you stay motivated and focused on changing your financial habits.

6. Create a budget: Develop a realistic budget based on your income and financial goals. Allocate your income to cover your essential expenses, savings, and debt payments. Stick to your budget as much as possible and make adjustments as needed.

7. Develop healthy financial habits: Replace detrimental habits with better ones. For example, instead of impulsive buying, practice the 24-hour rule by waiting a day before making a non-essential purchase. Focus on saving regularly, automating your savings if possible, and avoiding unnecessary debt.

8. Seek support and education: If you need help, consider seeking support from a financial advisor or joining financial management programs in your community. Educating yourself about personal finance and seeking guidance can provide you with the tools and knowledge to make better financial decisions.

9. Monitor your progress: Regularly review your financial habits and track your progress. Celebrate small victories and make adjustments as needed. Stay committed to your financial goals and continue to make sustainable changes over time.

Remember, changing financial habits takes time and effort. Be patient with yourself and stay motivated by focusing on the long-term benefits of improving your financial well-being.

Different Money Mindsets

Broadly, money mindsets can be categorised into types like the saver (who prioritises saving), the spender (who enjoys spending), the avoider (who avoids financial decisions), and the investor (who focusses on growing wealth). Identifying which category you predominantly fall into can provide insights into your spending behaviours. Understanding your money mindset is crucial because it can influence your financial decisions, habits, and overall well-being.

Here’s a breakdown of each money mindset type:

1. The Saver: A saver is someone who prioritises saving money and values financial security. They are often cautious with their spending, enjoy seeing their savings grow, and may feel uncomfortable with unnecessary expenses. Savers tend to have long-term financial goals and are more likely to prioritise saving for the future rather than indulgent purchases.

2. The Spender: A spender enjoys spending money and may find satisfaction in buying experiences, luxury items, or treating themselves and others. They may prioritise immediate gratification over long-term financial goals. Spenders might feel uncomfortable with saving money and find it challenging to resist purchasing things without really thinking about it.

3. The Avoider: An avoider is someone who avoids dealing with financial matters, such as budgeting, investing, or planning for the future. They may have limited knowledge or interest in personal finance and may feel overwhelmed or anxious about money-related discussions. Avoiders may prefer to live day-to-day without considering long-term financial goals.

4. The Investor: An investor focusses on growing wealth through strategies like investing in stocks, real estate, or other assets. They have a long-term perspective and believe in making their money work for them. Investors tend to educate themselves on financial matters, take calculated risks, and actively seek opportunities to increase their net worth.

It’s important to note that individuals may display characteristics from multiple money mindsets, and these mindsets can change over time based on personal experiences, circumstances, and financial goals.

By identifying your predominant money mindset type, you can gain insights into your financial behaviours and preferences. This awareness allows you to make more informed decisions, align your financial goals with your mindset, and develop healthier financial habits.

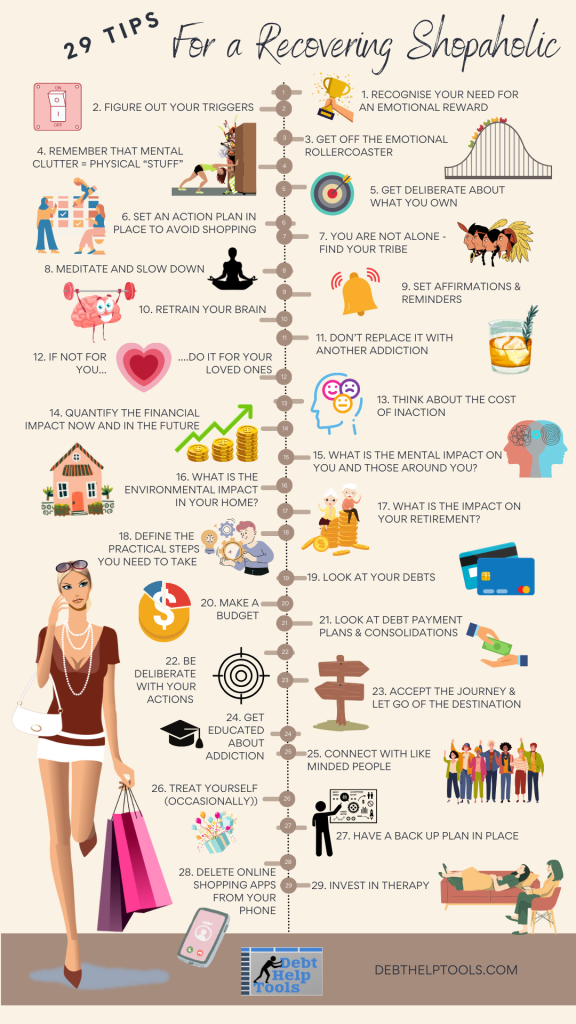

Strategies to Stop Overspending

Begin with a realistic budget that accounts for all your expenses and savings.

Set clear financial goals, both short-term and long-term.

Regularly track your spending to stay accountable.

And most importantly, invest time in building your financial literacy. Knowledge is power, and understanding financial concepts can empower you to make better decisions. – Identify your triggers and develop strategies to avoid or manage them.

For example, if you tend to overspend when shopping online, remove saved payment information from your favourite websites or limit your access to online shopping platforms.

– Use cash or debit cards instead of credit cards. This can help you keep track of your spending more easily, as you can physically see the money leaving your wallet or bank account.

– Practice delayed gratification. Instead of making impulsive purchases, wait a certain period of time before buying non-essential items. This will give you time to evaluate whether the purchase is necessary or if it’s just a fleeting desire.

– Prioritise essential expenses and savings before discretionary spending. Make sure you cover bills, debt payments, and savings contributions before deciding how much you have left for non-essential purchases.

– Avoid temptation by unsubscribing from marketing emails, unfollowing social media accounts or influencers that promote excessive spending, and avoiding situations or places that trigger impulsive buying.

– Find alternative ways to fulfil emotional needs that are driving your overspending. For example, if you tend to shop when you’re feeling stressed or sad, try engaging in activities like exercise, meditation, or spending time with loved ones instead.

– Plan and prepare meals at home instead of dining out, as eating out can add up quickly. Similarly, try to find free or low-cost activities for entertainment instead of constantly splurging on expensive outings or events.

– Involve accountability partners or support systems. Share your financial goals and progress with a trusted friend or family member who can help keep you accountable. You can also consider joining a financial literacy group or seeking help from a financial advisor or counsellor.

– Celebrate milestones and accomplishments without overspending. Reward yourself with small, inexpensive treats or experiences that align with your budget and financial goals, rather than splurging on extravagant rewards that could derail your progress.

The Impact of Overspending on Mental Health

Financial strain doesn’t just affect your wallet; it takes a toll on your mental well-being too.

Effects of Debt on Mental Health

The weight of debt can lead to overwhelming stress, anxiety, and in severe cases, depression.

The constant worry about paying off debts, coupled with the regret of past spending decisions, can be mentally exhausting.

1. Stress and anxiety: Debt can create a constant state of stress and anxiety for individuals. The fear of not being able to make payments on time or falling behind can lead to sleep disturbances, loss of concentration, and irritability. Persistent stress can also contribute to the development of chronic health issues, such as high blood pressure and heart disease.

2. Depression: For some individuals, debt can lead to feelings of hopelessness and despair, resulting in depression. The weight of financial burdens can make it difficult to find joy in daily activities, leading to a loss of interest or pleasure. Debt-related depression can also worsen existing mental health conditions.

3. Reduced self-worth and self-esteem: Debt can negatively impact an individual’s self-image and sense of self-worth. The feeling of being trapped in a cycle of debt and financial insecurity can erode confidence and self-esteem. This can result in a diminished sense of personal worth and feelings of shame or guilt.

4. Relationship strain: Debt-related stress can lead to increased conflict and tension within relationships. Financial problems can cause strain between partners, leading to arguments and disagreements about money management. This can further exacerbate feelings of stress and anxiety, as well as negatively affect overall relationship satisfaction.

5. Reduced ability to seek help: Individuals overwhelmed by debt may avoid seeking help or support due to feelings of embarrassment or stigma. They may experience a sense of shame or failure, which can prevent them from reaching out for assistance. This isolation can further intensify feelings of stress and anxiety.

6. Impact on overall well-being: Debt can affect various aspects of a person’s life, including their ability to save for the future, pursue educational or career goals, and enjoy leisure activities.

The constant preoccupation with debt and financial hardship can limit opportunities for personal growth and overall life satisfaction.

It is important for individuals struggling with debt and its impact on their mental health to seek support from professionals, such as financial counsellors or therapists. They can provide guidance, strategies, and emotional support to help individuals manage their debt and improve their mental well-being.

Improving Financial Habits

Change doesn’t happen overnight. It requires consistent effort, discipline, and support. Surround yourself with individuals who understand and support your financial goals. Consider seeking advice from financial experts or coaches. Celebrate small milestones to stay motivated.

Key Points to Remember

As we wrap up, remember that understanding your unique money mindset and the psychological reasons behind your compulsive behaviour is crucial. Recognise the psychological factors that influence your spending habits.

Equip yourself with financial knowledge and prioritise your mental well-being. With dedication and the right strategies, you can break the cycle of overspending and pave the way for a brighter financial future

– Understanding your money mindset is crucial for managing your finances effectively.

– Recognise and address the psychological factors that influence your spending habits.

– Equip yourself with financial knowledge and skills to make informed decisions about your money.

– Prioritise your mental well-being and find healthy ways to cope with stress and emotions without relying on overspending.

– Dedicate yourself to adopting the right strategies for managing your spending and saving.

– Breaking the cycle of overspending takes time and effort, but it is possible with dedication and the right approach.

– By breaking the cycle of overspending, you can pave the way for a brighter financial future.