Financial Literacy for Kids and Teens: A Guide to Teaching Money Management Skills

As parents and carers, we all want our kids to grow up with the knowledge and skills they need to make smart financial decisions (probably better than the ones we did…!). This article aims to guide you towards some of the best resources in this space and give you the opportunity to set your young person on the right financial path towards a brighter, happier and richer future.

The State of Financial Education

We are all aware that financial literacy is a critical life skill that is, to varying extents, overlooked in our school systems. To measure the extent of the impact that this is having on the next generation, there are a number of very fine financial institutions that conduct international surveys and hold extensive data on these matters.

One of these is the OECD (Organisation for Economic Co-operation and Development) who conduct financial literacy assessments as part of its Programme for International Student Assessment (PISA). These assessments aim to measure the financial literacy of 15-year-olds in participating countries. The results provide insights into the level of financial education and literacy amongst the youth in these countries.

The latest of these surveys was conducted in 2018 (and published in 2020) and the assessment covered 20 countries and economies: Australia, Brazil, Bulgaria, Canadian provinces (British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario and Prince Edward Island), Chile, Estonia, Finland, Georgia, Indonesia, Italy, Latvia, Lithuania, Peru, Poland, Portugal, the Russian Federation, Serbia, the Slovak Republic, Spain and the United States.

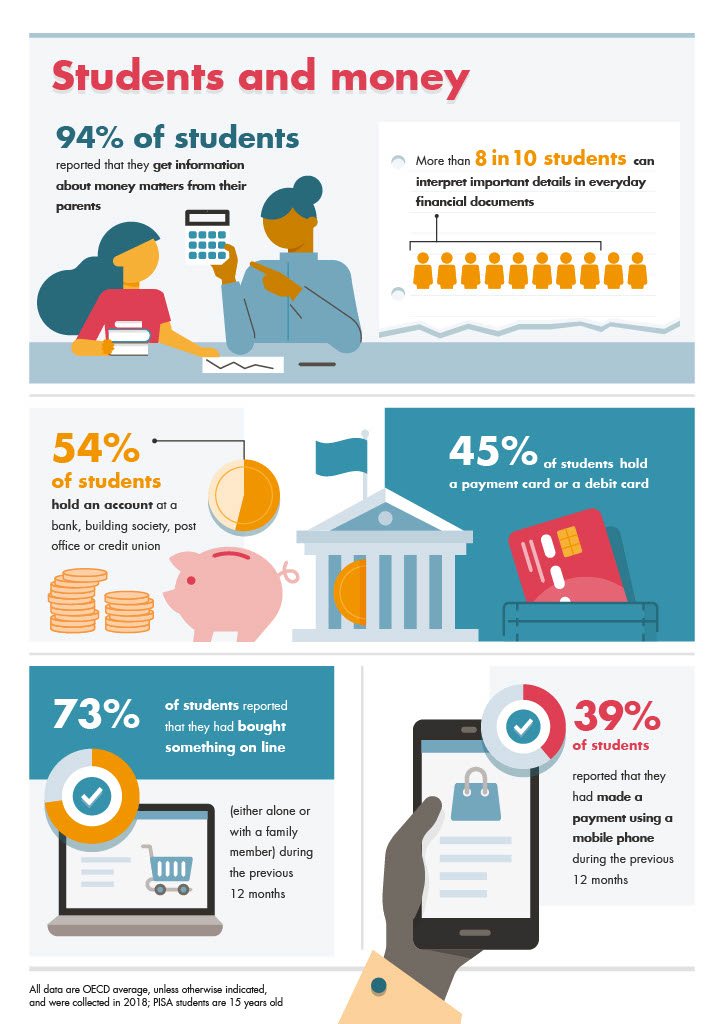

The full results of the OECD’s 2018 reports can be read here, but for the purposes of this article I find it interesting to note that 94% of students report that they get information about money from their parents – no pressure then eh?!

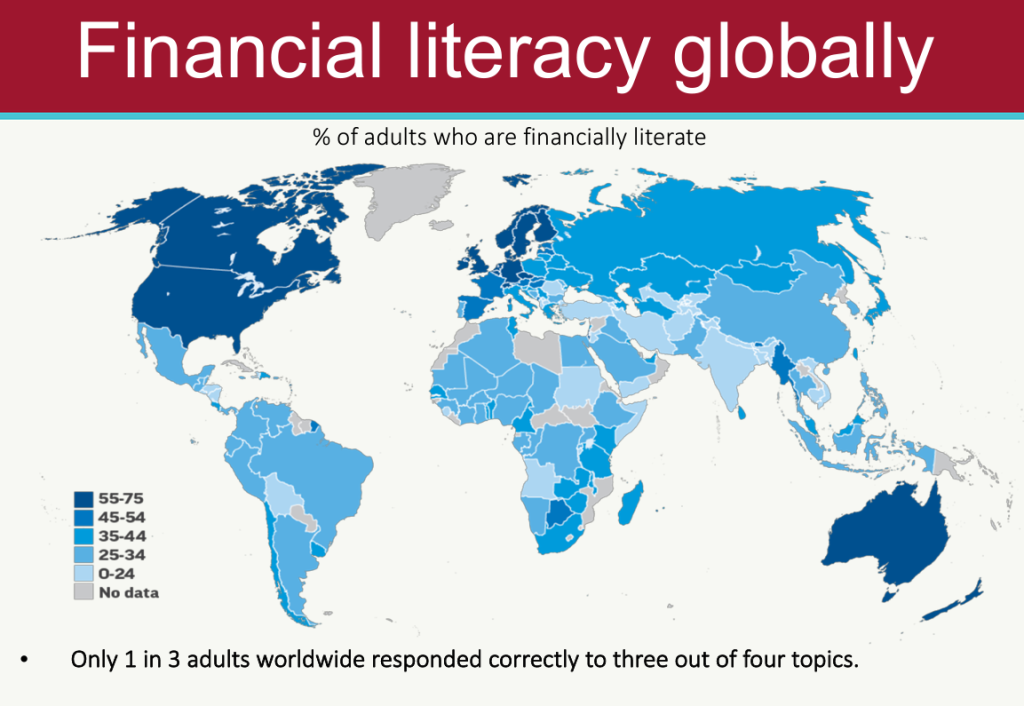

Another is the World Bank who hold the Global Findex Database which, while not exclusively focused on financial literacy, provides extensive data on how individuals save, borrow, make payments, and manage risks in various countries. This data can provide insights into the level of financial literacy in different regions.

An interesting extract from this report shows financial literacy scores on a global scale, which, when we consider that 94% of students get their financial education a home, means that in far too many cases this is just perpetuating poor financial literacy down the generations.

Teaching Financial Literacy for Kids & Teens at Home

Teaching financial literacy to kids and teens is more important than ever. With the rise of digital transactions and the increasing complexity of financial products, young people need to be equipped with the right skills to navigate the every changing and evolving financial world.

By teaching your child about money, savings, and spending, you can help them develop the financial literacy skills they need to make informed decisions about their money & their future.

But first, we must ourselves become more financially literate so that we pass along the right skills and beliefs about money, it may unfortunately be a case of teaching them to do as we say, not necessarily as we have done.

In our post on Financial Literacy in Home Education we reference excellent resources for children of varying ages, but it’s hard to really teach our kids anything unless we fully understand it ourselves.

MYDOH.ca have a great article entitled “parents guide to financial literacy” which you may find useful, but in all honestly, despite having an MBA in Finance, I have learnt the most useful and actionable things from YouTube and Audible! I’ve linked a few of my favourites below and made a list of my favourite UK based finance books that i think are awesome.

Understanding Money: The Basics

When it comes to financial literacy, understanding the basics of money is crucial. In this section, we’ll cover two important concepts that are fundamental to building a strong financial foundation: currency recognition and value, and earning money.

Currency recognition and value refer to being able to identify the different types of money used in a particular country and understanding their worth. Most countries have their own currency, such as the United States Dollar (USD), Euro (EUR), or Japanese Yen (JPY). It is important to be able to recognise and differentiate these currencies to effectively participate in financial transactions.

Understanding the value of money involves knowing its purchasing power. The value of money is determined by various factors, such as supply and demand, inflation, and governmental policies. For example, if the value of a currency decreases due to inflation, it means that the same amount of money can buy fewer goods or services.

Earning money is the process of obtaining income through various means, such as employment, entrepreneurship, or investments. Earning money is an essential part of personal finance as it enables individuals to meet their needs, save for the future, and achieve financial goals.

Overall, knowing the basics of currency recognition and value, as well as understanding the process of earning money, lays the groundwork for financial literacy and responsible money management.

A great book that cover all the basics here (not too shabby for us parents too tbh is Personal Finance For Dummies, sad but true – it’s really useful!

Financial Literacy for Kids

Financial Literacy for Teens

Personal Finance

Currency Recognition and Value

Before you can start earning and managing money, you need to be able to recognise different currencies and understand their values. This means knowing how to identify different notes and coins, and understanding how much they are worth.

One way to help kids learn about currency recognition and value is to create a chart or table that lists different notes and coins, along with their values. You can also use games and activities to make learning about money more fun. For example, you could play a matching game where kids have to match different notes and coins with their values.

Learn About Money Through Earning Money

Earning money is an important (some might say crucial!) part of life, and it’s never too early to start teaching kids about it. There are many ways that kids can earn money, from doing chores around the house to starting their own small business.

One popular way to educate children about earning money is through an allowance. An allowance is a set amount of money that kids receive on a regular basis, usually in exchange for completing certain chores or tasks. This can help kids learn about the value of money and the importance of saving and spending wisely.

Another way to help kids earn money is by encouraging them to start their own small business, such as a lemonade stand or a dog-walking service. This can teach kids valuable skills such as budgeting, marketing, and customer service, while also giving them a sense of responsibility and independence.

Overall, understanding the basics of money is essential for building a strong financial life. By teaching the next generation about currency recognition and value, and helping them earn and manage their own money, you can set them up for a lifetime of financial success.

Add data here about go henry rewards and other apps that kids can track activities but also pose the argument that psychologically it might not be the best thing to teach kids if you want them to think about money as more than a task / reward system

Home Education and Resources

As mentioned, about 94% of children get their financial education at home, whether they are being homeschooled or are attending some form of state or private education system, this is no small burden for us caregivers!

If you are in the UK (or maybe even if you are not!) – I highly recommend downloading the Money Saving Experts text book designed to address this shortfall in financial education.

Investopia’s article on finanical education resources for kids notes some of the following and are great, regardless of where you are in the world.

Podcasts:

- Million Bazillion: A podcast by Green-light that explains basic economic concepts in a fun way.

- Money With Mak & G: A weekly podcast hosted by a certified public accountant and his twins, explaining financial concepts.

- Apps:

- Savings Spree: An app for Apple devices that teaches kids the long-term consequences of how they manage money.

- Books:

- The Everything Kids’ Money Book by Brette Sember: A book that helps kids learn the basics of the economy and how to become more responsible with their money.

- Comic Books:

- Federal Reserve Educational Comic Books: A comic book series developed by the Federal Reserve Bank of New York to teach economic and financial concepts.

- Websites:

- Hands on Banking: A website that provides free articles and videos to help older children and young adults improve their financial literacy.

- Online Classes:

- Juni: Offers online classes where kids aged 9 to 18 learn the basics of investing, entrepreneurship, and building credit.

Additionally, Investopia mention the use of mobile apps and online classes that help kids learn money skills, such as Investmate for teens to learn the basics of stock trading, and platforms like EVERFI and Outschool for financial literacy offerings.

Fiscal Tiger provides a plethora of resources categorised by age groups to promote financial literacy amongst children and teenagers. Here are some of the resources mentioned in their posts about how to talk to your kids about money:

For Toddlers:

- Apps:

- Numbers from Dragonbox: Helps children ages four to eight learn about numbers.

- Cash Puzzler: Free game designed for children ages three to six to recognise different denominations of bills.

- Piggybot: Free allowance app designed for children ages four and older to track allowance spending and saving.

- Bankaroo: Free virtual bank for kids ages four and older to manage their allowance, gifts, and chore money.

For Elementary School Students:

- Apps:

- Peter Pig’s Money Counter: Free game to learn about counting, budgeting, and saving money.

- Break the Bank – Sorting: Free game to learn how to sort money.

- Savings Spree: ($5.99) Teaches kids how daily lifestyle choices can result in savings or expenses.

- Websites:

- Consumer Financial Protection Bureau: Offers free information, activities, and discussion points on various financial topics.

- Financial Literacy for Kids: Offers guidance, lesson plans, and activities for financial literacy.

For Middle School Students:

- Apps:

- The Frugality Game: Free 90-day learning game teaching personal finance and money lessons.

- Financial Football: Free fast-paced interactive game teaching money management skills.

- The Budget Game: Free game to manage a budget for three months.

- Websites:

- Personal Finance Fun and Games: Free webinar providing resources and games supporting different learning styles in budgeting, credit, and investing.

For High School Students:

- Apps:

- The Payoff: Free role-playing game managing finances and handling unexpected events.

- The Stock Market Game: Requires registration but builds fundamental knowledge of investing.

- Gen i Revolution: Free game completing missions with personal finance skills to help people in financial trouble.

- Websites:

- Money Smart for Young People: Free curriculum including lessons, presentation slides, worksheets, and activities covering a range of personal finance and economic topics.

Another excellent resource is this BrightChamps post about teaching financial literacy to kids – definitely worth a read.

Budgeting and Saving: Building Financial Responsibility

Teaching children of all ages about budgeting and saving is an important part of developing their financial management skills. It helps them develop good money management skills and sets them up for a successful financial future.

In this section, we’ll cover two essential aspects of building financial responsibility: creating a budget and saving and investing.

Creating a budget is the foundation of good financial management. It involves tracking income and expenses to ensure that money is being spent wisely and in line with financial goals.

For younger children, start by introducing the concept of money and the value it holds. Teach them the difference between needs and wants, and discuss the importance of making choices with limited resources. As they get older, provide them with an allowance and help them create a simple budget to allocate their money towards different categories such as saving, spending, and giving.

For older children and teenagers, help them track their expenses and income using online tools or budgeting apps. Encourage them to set financial goals such as saving for a specific purchase or working towards long-term goals like college or a car. Teach them to prioritise their spending and make informed decisions about how to allocate their money.

Saving and investing are also crucial aspects of financial responsibility. Teach children the importance of saving money for emergencies or future expenses. Encourage them to set aside a portion of their income or allowance towards savings. Help them open a savings account and explain the concept of interest and how their money can grow over time through compound interest.

As children get older, introduce them to the concept of investing. Teach them about different investment options such as stocks, bonds, and mutual funds. Explain the risks and rewards associated with investing and the importance of diversifying their investments. Encourage them to start investing early and regularly to take advantage of the power of compounding.

In addition to teaching budgeting and saving, it’s important to lead by example. Children learn by observing their parents’ financial behaviours and attitudes towards money. Show them responsible money management by budgeting, saving, and making informed financial decisions. Involve them in family discussions about money and include them in financial planning and decision-making when appropriate.

By teaching children about budgeting, saving, and investing from an early age, parents can instil good financial habits that will benefit them throughout their lives. These skills will help them make sound financial decisions, avoid debt, and achieve their financial goals. Personal finance for teens: creating a budget

Creating a budget is an essential part of managing their money. It involves tracking your income and expenses and making a plan for how you will spend your money. Here are some tips for creating a budget:

- Start by tracking your income and expenses. This will help you understand where your money is going and identify areas where you can cut back.

- Make a list of all your expenses, including fixed expenses like rent or mortgage payments, as well as variable expenses like groceries and entertainment.

- Set spending limits for each category of expenses and stick to them.

- Use budgeting tools and resources to help you stay on track. There are many free resources available online, including budgeting apps and templates.

How to Teach Kids About Saving and Investing

Saving and investing are essential components of building financial responsibility. They help you build wealth over time and prepare for unexpected expenses. Here are some tips for saving and investing:

- Start by setting savings goals. This could be anything from saving for a new bike to saving for college.

- Create a savings plan that includes a set amount to save each month.

- Consider opening a savings account or investment account to help you save and earn interest.

- Teach your kids about the power of compound interest and how it can help their money grow over time.

- Encourage your kids to invest in stocks or mutual funds. There are many resources available online that can help you get started, including investing for kids guides and tutorials.

By teaching your kids about budgeting and saving, you’re helping them develop essential financial skills that will serve them well throughout their lives. With the right resources and education, they can learn how to turn a small amount of money into a substantial sum over time.

ADD DATA HERE ABOUT JUNIOR SIPS AND SOME COMPOUND INTEREST CHARTS TO SHOW HOW SAVING FROM A REALLY YOUNG AGE CAN COMPOUND OVER TIME TO HUGE SUMS IN LATER LIFE

Banking Basics

If you want to learn about financial literacy, it’s essential to understand the basics of banking. Banking is an integral part of personal finance, and it’s crucial to learn how to use banks to help manage your money effectively. Opening a Bank Account

One of the first things you need to do is open a bank account. It’s a simple process, and most banks offer accounts designed specifically for children.

These products tend to evolve as the child grows and becomes more independent.

When opening a bank account, you will need to provide some personal information, such as your name, address, and date of birth. You may also need to provide identification, such as a passport or a driving licence.

Once you have opened a bank account, you can start using it to save money, receive payments, and make transactions. Some banks offer interest on savings accounts, which means that you can earn money on your savings. It’s essential to understand how interest works and how it can benefit you in the long run. Using a Bank Account

Once you have opened a bank account, you can start using it to manage your money. Here are some of the things you can do with a bank account:

- Deposit money: You can deposit money into your account by visiting a bank branch or using an ATM.

- Withdraw money: You can withdraw money from your account by visiting a bank branch or using an ATM.

- Online banking: Most banks offer online banking, which allows you to manage your account from anywhere with an internet connection.

- Debit cards: Some banks offer debit cards, which allow you to make purchases and withdraw money from ATMs.

- Savings: You can use your bank account to save money for the future. Some banks offer savings accounts with higher interest rates than regular accounts.

- Budgeting: You can use your bank account to help you budget your money effectively. By keeping track of your income and expenses, you can make sure you are not spending more than you earn.

In conclusion, understanding banking basics is an essential part of financial literacy. By opening a bank account and learning how to use it effectively, you can develop important skills that will help you manage your money and plan for your financial future.

ADD DATA ABOUT WELL RESPECTED BANKS AND THE OFFERINGS THAT THEY HAVE FOR DIFFERENT AGE GROUPS – LINK TO A REVIEW ON THE BEST AND WORST, PLUS ADD MY OWN SPIN ON THIS

Credit and Debt: A Double-Edged Sword

Credit and debt can be a double-edged sword.

On one hand, credit can help you achieve your financial goals, such as starting a business or buying a home. If you don’t use credit at all, you’ll have no credit rating which can look really bad when you come to apply for a mortgage. Some employers also look at your credit rating so keeping a good score has many benefits.

On the other hand, debt can quickly spiral out of control and lead to financial ruin. It’s important to understand credit and debt so that you can make informed decisions about your personal finances. Learning this at a young age is absolutely crucial and something that is sadly lacking from today’s education system.

Credit is a financial tool that allows individuals to borrow money with the promise to repay it at a later date. It is often necessary to obtain credit in order to make large purchases, such as a house or a car, that would be difficult to afford upfront. By using credit responsibly and making timely payments, individuals can build a good credit history, which can in turn help them access better loan terms and interest rates in the future.

However, misuse or excessive reliance on credit can quickly lead to debt.

When individuals accumulate debt, they are essentially borrowing money that they do not have, and they are required to repay it over time.

High levels of debt can be financially burdensome, as individuals may struggle to meet their monthly payments and interest charges. This can lead to a lower credit score, increased stress, and difficulty in obtaining credit in the future.

One additional point on this is access to “cheap” debt and how a low credit rating means you pay way more for what you borrow, which takes much longer to pay off and keeps you out of the running on the investment train

ADD DATA HERE WITH SOME GRAPHS ON HOW THIS MIGHT LOOK OVER TIME

One of the dangers of debt is the interest that is charged on borrowed money.

Interest is essentially the cost of borrowing, and the higher the interest rate, the more money individuals will have to repay.

If individuals are unable to manage their debt properly or if they accumulate debt with high interest rates, they may find themselves in a debt cycle where it becomes difficult to make payments and get out of debt.

To avoid falling into excessive debt, it is important to use credit wisely.

This involves creating a realistic budget, living within one’s means, and only taking on debt that can be repaid comfortably. It is also important to monitor credit card balances and pay bills on time to avoid late fees and penalties.

Additionally, it’s important to review credit reports regularly to ensure there are no errors or fraudulent activities that may negatively impact one’s creditworthiness.

In summary, credit and debt can be a double-edged sword. Properly managed and used responsibly, credit can be a valuable tool to achieve financial goals. However, excessive debt can lead to financial struggles and ruin creditworthiness.

By understanding credit and debt and making informed decisions, individuals can avoid the pitfalls of debt and have a much better chance of achieving financial success.

Understanding Credit

Credit is the ability to borrow money or obtain goods or services before payment.

It’s important to understand that credit is not free money.

When you use credit, you are borrowing money that you will need to pay back with interest. Interest is the cost of borrowing money and is usually expressed as a percentage of the amount borrowed.

Credit can come in many forms, such as loans, credit cards, and lines of credit.

Each type of credit has its own terms and conditions, including interest rates, fees, and repayment schedules.

It’s important to shop around and compare different options before choosing a type of credit. Having good credit is important for a variety of reasons. It can affect your ability to get a loan or credit card, as well as the interest rates you’ll be charged.

Lenders use your credit score, a numerical representation of your creditworthiness, to determine whether or not to lend you money and at what terms.

To build good credit, it’s important to make all of your payments on time and in full.

This includes payments for loans, credit cards, and other bills. It’s also important to keep your credit card balances low and avoid maxing out your credit cards.

If you have a low credit score or no credit history, it can be more difficult to get approved for credit.

There are options available, such as secured credit cards or loans, that can help you build credit. It’s important to use these responsibly and make all payments on time to improve your credit.

Overall, understanding credit and how it works is important for managing your finances and making informed decisions about borrowing money.

Money Management & Managing Debt

Debt is the amount of money that you owe. When you use credit, you are taking on debt. It’s important to manage your debt carefully to avoid financial problems. Here are some tips for managing debt:

- Create a budget: A budget can help you keep track of your income and expenses and ensure that you have enough money to make your debt payments.

- Pay on time: Late payments can damage your credit score and lead to additional fees and interest charges.

- Pay more than the minimum: If you only make the minimum payment on your debt, it will take longer and cost more to pay off. (unless you have a 0% card – then you need to save it up somewhere that is PAYING you interest until such time as the card is due to be paid in full)

- Avoid new debt: Try to avoid taking on new debt while you are still paying off existing debt, unless you have a low risk way to invest cheap debt into a business that will return more than the debt is costing you. (ADD LINKS HERE)

If you are struggling with debt, there are resources available to help.

Many organisations offer free financial education and counselling services to help you manage your debt and improve your financial literacy. You can also consider debt consolidation or debt settlement as options for managing your debt.

Entrepreneurial Spirit: Encouraging Financial Innovation

Encouraging an entrepreneurial spirit in your children can be a great way to foster their financial innovation and help them develop valuable skills for their future. Here are some tips on how to do it. Fostering Entrepreneurship

- Encourage creative thinking: Encourage your children to think creatively and come up with new ideas. This can help them develop their problem-solving skills and think outside of the box.

- Provide opportunities for experimentation: Allow your children to experiment with different ideas and projects. This can help them develop their skills and learn from their mistakes.

- Teach them about money management: Teach your children about money management and how to budget and save their money. This can help them develop a better understanding of the financial aspects of entrepreneurship.

- Support their passions: Support your children’s passions and interests. This can help them develop a sense of purpose and drive, which can be essential for entrepreneurial success.

Case Studies: Successful Young Entrepreneurs

Here are some examples of successful young entrepreneurs who have developed their financial skills and achieved success:

- Moziah Bridges: Moziah Bridges is the founder of Mo’s Bows, a company that sells handmade bow ties. He started the company when he was just nine years old and has since been featured on Shark Tank and in Forbes magazine.

- Mikaila Ulmer: Mikaila Ulmer is the founder of Me & the Bees Lemonade, a company that sells lemonade made with honey instead of sugar. She started the company when she was just four years old and has since been featured on Shark Tank and in Time magazine.

- Alina Morse: Alina Morse is the founder of Zollipops, a company that sells sugar-free lollipops. She started the company when she was just seven years old and has since been featured on Shark Tank and in Forbes magazine.

By encouraging your children to develop an entrepreneurial spirit, you can help them develop valuable skills and achieve financial success in the future.

Tools and Resources: Advancing Financial Literacy

Teaching financial literacy to our youth is important for their future financial well-being. Fortunately, there are many tools and resources available to help parents and educators advance this area of study. Educational Resources

There are many free educational resources available to help the younger generation learn about personal finance and financial education. National Geographic Kids: Everything Money is a great resource for younger children, while books such as How to Turn $100 into $1,000,000, Show Me the Money, and Make Your Kid a Money Genius (Even If You’re Not) are great for older kids.

Beth Kobliner’s How to Turn $100 into $1,000,000: Earn! Save! Invest! and Show Me the Money: Big Questions About Finance are also great resources.

In addition to books, there are also free online resources available for educators and parents. The Financial Educators Council offers free financial literacy lesson plans and activities, while the Money Advice Service offers free resources and tools for parents to teach their children about money. Community Involvement

Community involvement can also be a great way to advance financial information for children.

Mentorship programs can provide guidance and support for kids and teens as they learn about personal finance. Local colleges and universities may also offer money management courses or workshops for teens.

Parents can also get involved by volunteering at schools or community centres to teach practical real world finance. This can be a great way to give back to the community and help the entire neighbourhoods children develop important financial skills.

Overall, there are many tools and resources available to help teach kids about money. By taking advantage of these resources and getting involved in the community, parents and educators can help set our children up for future financial success. The Importance of Financial Literacy

Financial literacy is crucial for all individuals of every age group to make informed decisions about their personal finances and achieve financial stability. Here are some important reasons why financial literacy is important:

1. Making Informed Financial Decisions: Financial literacy enables individuals to make informed decisions about saving, investing, budgeting, and managing debt. It helps them understand complex financial concepts and navigate the financial system effectively.

2. Avoiding Financial Pitfalls: Financially literate individuals are less likely to fall into debt traps, predatory lending, or scams. They have the knowledge to recognise and avoid high-cost financial products, make wise investment choices, and protect themselves from fraudulent activities.

3. Building Wealth: Financial literacy empowers individuals to build wealth and create a secure financial future. By understanding concepts such as compounding interest, diversification, and long-term investing, they can make sound financial decisions leading to wealth accumulation and financial independence.

4. Planning for Retirement: Financial literacy is essential for retirement planning. It helps individuals understand different retirement savings options, such as 401(k)s or individual retirement accounts (IRAs), and make informed choices about investing and withdrawal strategies.

5. Managing Personal Finances: Financial literacy teaches individuals how to create and manage budgets, track income and expenses, and establish emergency funds. These skills are crucial for effective personal financial management and avoiding unnecessary financial stress.

6. Teaching Responsible Money Habits: By developing financial literacy skills, individuals can teach their children responsible money habits, fostering financial literacy in future generations. This helps break the cycle of poor financial decision-making and ensures a better financial future for families.

7. Making Informed Consumer Choices: Financially literate individuals can efficiently evaluate and compare financial products and services such as mortgages, insurance policies, or credit cards. This enables them to make informed choices, find the best deals, and save money.

8. Understanding Economic Concepts: Financial literacy helps individuals understand macroeconomic concepts such as inflation, interest rates, taxes, and economic cycles. This knowledge allows them to navigate economic fluctuations, plan for contingencies, and adjust their financial strategies accordingly.

Conclusion

Congratulations! You have taken a significant step towards securing your child’s financial future by teaching them about financial literacy. As a parent or educator, you play a crucial role in shaping your child’s financial habits and behaviours.

By imparting financial knowledge and skills to your child, you are giving them the tools they need to make informed decisions about money, both now and in the future. You are also helping to ensure that they avoid common financial pitfalls and enjoy a secure their future.

Remember that financial literacy is an ongoing process, and there is always more to learn. Encourage your child to continue to develop their financial knowledge and skills, and to seek out resources and advice when needed.

As a call to action, consider incorporating financial literacy into your child’s daily life. Encourage them to set financial goals, create a budget, and save money. You can also teach them about investing, credit management, and financial planning.

In conclusion, financial literacy is an essential life skill that every child and teen should learn. By teaching your child about financial literacy, you are setting them up for a successful life in so many ways.

Best Pocket Money Apps UK

Top 10 Best Pocket Money Apps UK Are you a parent eager to equip your child with essential money management skills…

Whats the Best Childrens Bank Account in the UK?

Whats the Best Childrens Bank Account in the UK? Empowering the next generation with financial literacy is crucial, and what better…

Financial Literacy in Home Education: Useful Resources to Get You Started

Financial Literacy in Home Education: Useful Resources to Get You Started Choosing to home educate regardless of where you live…

Financial Literacy for Kids and Teens

Financial Literacy for Kids and Teens: A Guide to Teaching Money Management Skills As parents and carers, we all want our kids…