How to Use The Excel Budget Planner

This comprehensive excel budget planner automatically works everything out for you. Just add add income into the income tab and spend into the spend tab and the results will be summarised on the Summary tab!

It’s a super simple way to manage your household, personal or even small business budgets as it shows you at a glace where all your money is coming from and often more importantly; where it is going to.

How The Excel Budget Planner Spreadsheet Works

It’s super simple to use, even if you’ve never used an excel template before.

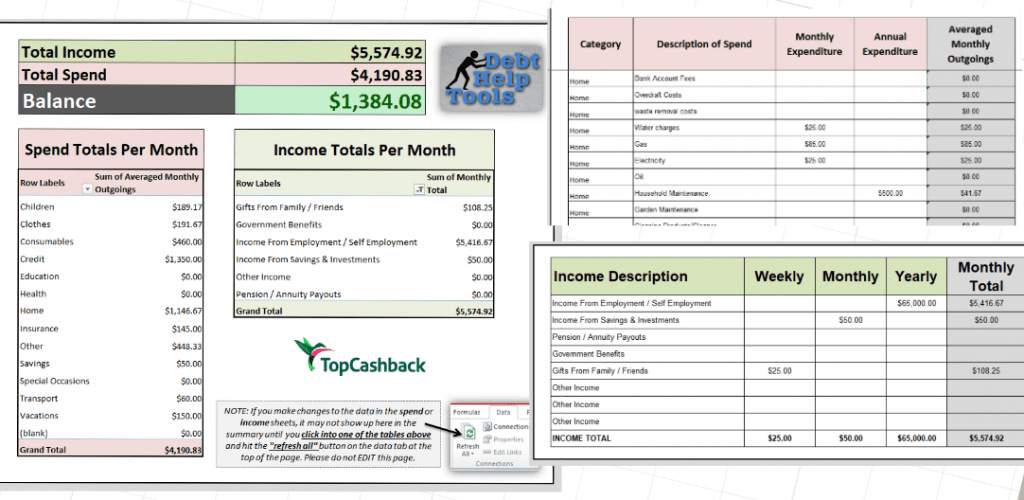

To give you some ideas, the download file has an example budget template in the first sheet – you can see how all the numbers work out to the summary totals and what general headings for expenditure, bills and income you might want to use.

The main file consists of 3 sheets.

Your first task will be to add in all your income into the income tab: like this………………….

As you can see, there is a calculation in the sheet that automatically works out what your monthly income will be based on your inputs into the weekly, monthly or yearly columns. all you have to do is make sure that you only enter numbers into these fields, it will automatically add the dollar sign so you don’t need to add that in.

This is really useful if you get money at odd times in the month or the year, just add in when you usually receive it and the totals will work themselves out – just like magic!

Adding Expenses To The Budget Spreadsheet

Next you will need to enter all your expenditure into the expenses tab: like this……………………..

Here you will notice that there is an extra column for you to add a category for your spend. You don’t have to use this if you don’t want to but you will see how useful this is when we get to the summary page!

As with the income sheet, there is a calculation in the sheet that automatically works out what your monthly expenditure will be based on your inputs into the monthly or yearly columns. All you have to do is make sure that you only enter numbers into these fields, it will automatically add the dollar sign so again, you don’t need to add that in.

The Budget Summary is Calculated for You!!

Finally we arrive at the summary page where all the figures that you have entered into the previous 2 sheets can be seen, sumarised in one place.

The spend totals are grouped into categories (these are the ones that you added above) so that you can easily see where all your money is going.

The total income and total spend values at the top of this page are a summary of your monthly activity. This might look a little different to your current budget plan because both the spend and income sheets allow for any yearly lump sums that you might receive or pay out; such as annual bonuses or tax bills.

Printable Budget Work Sheet

We have optomised the above sheet for printing so if you don’t want to use the automated version, please feel free to download our printable option and fill it in at your leasure.

Please click HERE or any of the images above and we will send you a link to access ALL our free downloads.

Also, we promise; no spam or newsletters, we we only get in touch when we have something new that we think you might like.

If you would like to have a go at making your own printable budget sheet, or any other printable form or schedule for that matter, take a look at THIS. We’ve made a fancy version of the budget printable and put together some instructions on how you can make yur own FREE versions using a FREE VISME account.

So now that you have your budget sorted – how about you start work on your debts?

We’ve built a free cost of debt calculator that you might find really handy for this.

If you are struggling with debt right now, please don’t worry too much – I know it’s not easy but there is help avaialble.

If you are in the US try Debt.org

If you are in the UK, The money advise service is always a very reliable source of information

How to Withdraw Money from TopCashBack

How to Withdraw Money from TopCashBack Unlike some sites that limit what you can withdraw and how you can spend it – topcashback will actually

Bad Credit and What You Can Do About It: A Helpful Guide for Financial Recovery

Bad Credit and What You Can Do About It: A Helpful Guide for Financial Recovery Bad credit can feel like a financial anchor, especially when

How to Sell Digital Products on Etsy

How to Sell Digital Products on Etsy – And if it’s Worth it! Are you looking to sell digital products on Etsy? You’ve come to

Psychological Reasons for Overspending & How To Break The Cycle

Psychological Reasons for Overspending & How To Break The Cycle Breaking the cycle of overspending starts with understanding your unique money mindset and the psychology

Best Pocket Money Apps UK

Top 10 Best Pocket Money Apps UK Are you a parent eager to equip your child with essential money management skills in today’s digital age

Whats the Best Childrens Bank Account in the UK?

Whats the Best Childrens Bank Account in the UK? Empowering the next generation with financial literacy is crucial, and what better way to start than

Author

-

Hi, I'm Lindsey and I really love helping people & businesses get their money organised & their systems optimised. (I'm a bit weird I know) I have an MBA in finance & have been a self-employed management consultant since 2013. I've been super privileged to work on a wide range of projects in that time & each one has been an amazing opportunity to learn something new. This site aims to create a bank for that knowledge so that you can shortcut your journey to success & hopefully skip all the mistakes that I made! www.linkedin.com/in/uk-lindsey-briscoe