Are you a retail warrior seeking genuine happiness beyond the shopping cart? Being in Shopaholics Anonymous isn’t just about curbing the urge to splurge; it’s about understanding the emotional drive behind compulsive shopping. Dive deep into the shopaholic’s mindset, from the dopamine rush of a sale to the underlying triggers like stress or boredom. Embrace minimalism, find alternative joys, and seek support. Remember, true happiness isn’t tagged with a price. Ready to embark on a journey towards real, unboxed joy? Discover the roadmap to retail recovery and lasting fulfilment. 🛍️➡️🧘🎤🖌️🌟

Compulsive shopping, shopping addictions, or compulsive buying are part of a recognised addiction and should not be taken lightly. There are specific organisations and programs that can help with your over-shopping habits, these vary across the globe but in the US they can be found by searching for things such as “Shopaholics Anonymous” (Schulman Centre) and Debtors Anonymous. Check out our UK shopaholics post or read on for global support networks

Shopaholics Anonymous

We’ve all heard of Alcoholics Anonymous – or AA. A community of people who want to change their obsessive compulsive by giving up alcohol and deciding to abstain from even the smallest amount. The same organisation can be found for drugs (NA – Narcotics anonymous) and food addictions.

Unfortunatly at the time of writing, Shopaholics Anonymous is not a real organisation like AA. But you might find a specialist group near you that supports compulsive buying tendencies especially if you live close to a large city.

In all honesty, SA (shopaholics Anonymous) is just about the community and support it provides – so it’s as “real” as the group of like minded people you find to support you. Just because they don’t have an official website or registered business doesn’t mean that they aren’t real – it depends on your definition I guess.

Shopping addictions, or compulsive buying are part of recognised addictive behaviour sets (See the NCBI article here) and should not be taken lightly though they are often dismissed as “minor” by society when they can cause as much if not more harm to both the sufferers, their families and their wider community.

Using the 12 steps for a shopping addiction – Can it work?

People who join Alcoholics Anonymous are presented with a 12 step program to help them beat their addictions. It is a set of spiritual steps that aid in the recovery from alcohol abuse but has been adapted to address many other forms of addiction.

It is interesting to note that this group is not just for alcoholics – you don’t have to have a drinking problem to join. You can also be the friends and family of an alcoholic.

In this article, we will take a look at a set of 12 steps that are use in AA & NA and how they can be used for shopaholics.

Shopping to fill an emotional need

Most of the time, shopaholics or shopping addicts are motivated to shop to cope with the difficult emotions in their lives.

In extreme cases, addicts can become so focused on purchasing something that everything else in their life just becomes less important – Family, work, friends, cleaning the house, helping out with church or community – everything else turns grey – the only “buzz” or excitement is the current object of your desire.

[I’ve recently written a short Medium.com post with some key points for a recovering shopaholic that you might enjoy…]

Some time ago i came across the author, doctor and work renound addiction specialist “Gabor Mate” who himself was gripped by an obsession to purchase classical music CD’s. It sounds so silly to many of us but his description of the feeling and the compulsion that he felt despite rising debts and the needs of his family was very compelling – find his books on amazon UK HERE or watch this video of the author:

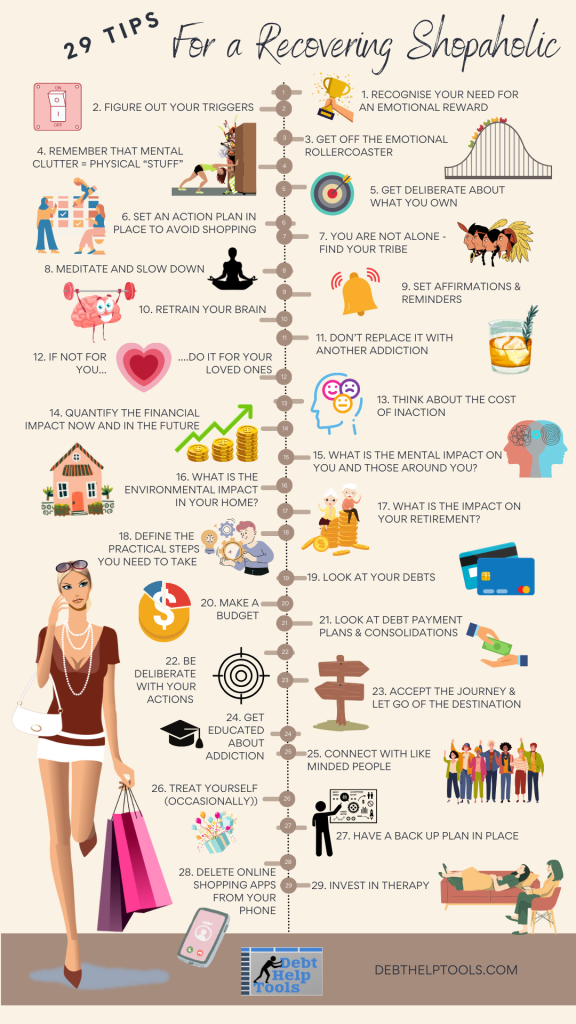

1. The emotional reward for compulsive shoppers

In essence, addictions hijack our reward systems (Dana.org). As humans, we should seek reward from productive and fulfilling activities. These activities produce dopamine in the brain – the happy hormone.

A shopping addiction rewires the brain. It makes you feel happy or “high” with just a tap of a button. When these habits become automatic and unsupervised, you may fall into problems like debt, anxiety, and depression.

2. What drives you to shop?

Before you quit your shopping addiction cold turkey, you need to take an in-depth look at the why behind your addiction. What drives you to shop? Do you find yourself daydreaming about buying a new bag because you’re having a bad day at work?

Is the thought of buying something giving you something to live for? You might need to sit down with a pen and a journal to figure out why you shop so much.

3. Getting off the emotional roller-coaster

When we really think about it: Shopping doesn’t fix anything – it just delays how you deal with important issues for a bit. So, you’re sad, and you go online and order yourself a new laptop. Sure, you feel a bit of a rush and coast on that for days.

But you didn’t get to the root of the problem: What made you sad? There are many ways to cope with your feelings of sadness or emptiness that won’t result in debt and emotional crashes.

4. Mental clutter and physical “stuff.”

Mental clutter means constantly thinking about shopping when you should be doing important things like work or hanging out with your family. A shopping addiction makes you distracted from the life in front of you.

Your shopping addiction makes you collect more and more stuff that you probably don’t have space for. How many of the things that you’ve bought are collecting dust at the bottom of your closet? Take a step back and study the effects of your shopping addiction.

5. Freedom of minimalism – being deliberate about the things you own

What is minimalism? Minimalism is the practice of consciously owning fewer possessions. As a shopaholic, you are probably the complete opposite of a minimalist.

Minimalism calls for intentionality – it means owning only the things that bring value to your life. It gives you freedom from the need to “possess” things. Step off the treadmill of consumerism. Less is better.

6. Action steps to take when you want to shop

Getting rid of a shopping addiction requires a plan. Quitting your compulsive buying will create a hole where your addiction once was. What are you going to start doing when you feel that itch to shop?

Write down a few activities that you think will help you when you want to shop compulsively. Here are some of the activities that can act as coping mechanisms to deal with your addiction:

• Diversions like writing, drawing, or gardening.

• Social coping activities like talking to friends and family or playing with pets.

• Cognitive coping activities like writing down new goals or to-do lists.

• Tension releasers like exercise and yoga.

7. You are not alone – get help

There are tons of people out there who over-shop to deal with emotional pain. The good news? There are also tons of people that have rehabilitated and curbed their shopping addictions. Get help today – whether it’s through therapy or by opening up to loved ones.

There are so many resources for getting over your shopping addiction, especially online. Consider online groups on social media apps like Facebook and Reddit. Here’s a collection of some resources for compulsive buying disorder:

Facebook groups:

Subreddits for shopaholics:

Online programs:

- Dress With Less Microcourse

- Svelte in Style: How to Look and Feel Great While Losing Weight

- Living with Ease: The Mindful Way to Dissolve Stress

8. Meditate and slow down

The next time you find yourself opening that online shopping app, slow down and take a breath. Try to fight it. Start with one minute of resisting the shopping urge. This is where meditation comes in.

Meditation is a great activity that therapists also use in CBT (Cognitive Behavioural Therapy). Taking deep breaths and spending time with your thoughts can help you to cool your shopping itch.

One free APP you might want to try is “Headspace” or book some time with a qualified counsellor if you really need some 1-2-1 support.

9. Affirmations and reminders

A great way to train yourself to curb your shopping addictions is to set up reminders on your phone so that you can say affirmations to yourself. Affirmations are a powerful way to change how you feel about yourself. Here are some examples of affirmations for a shopping addiction:

• I make the right choices for my life every day.

• I am worthy of living my best life.

• I am in control of my urges.

10. Why you need to retrain your brain

You can always change your mindset. You can start over. You don’t have to judge yourself based on your past. Every day is a new day to beat your compulsive buying and live the life you truly deserve.

You can start to retrain your brain by studying your shopping patterns. The first step is to identify your shopping triggers – the things that bring on the urge to buy new things. When you feel compelled to shop, find alternative activities to keep you busy and away from spending.

11. Don’t replace being a shopaholic with another “…aholic” addiction

Someone who gives up smoking might find themselves taking up a new addiction like food or some other socially acceptable addiction.

This kind of behaviour does not target the root cause of the addiction. Getting to your addiction’s root cause involves identifying your triggers and finding appropriate coping techniques to deal with these triggers.

Addressing addiction is a long term commitment that required support from loved ones and where possible a support group. Replacing your current addiction with another will not pay off those credit card bills or help you deal with whatever is underlying your compulsions.

12. Think about the kids & the people who look up to & care about you

Many people get motivated by a loved one, family members or close friends. They do their best for their friends and family, often more often than they take care of their own health and well-being.

remember that an addiction, however harmless and socially acceptable it may appear, also harms the people around you. Take out some time to think about how your mounting credit card debt, secret loan accounts and potential financial ruin might affect the people close to you. Your kids and the people who look up to you need you to get better.

13. What’s your cost of inaction?

What’s the worst thing that could happen if you managed to get your spending under control? Let’s take a brief look at the potential impact of no more buying new things:

14. Financial impact:

You’re going to be saving a lot more money for the things that will truly bring you joy, you might even be so far down the line that quitting now may even help you to avoid bankruptcy. foreclosure of bailiffs. take a good look at all your credit cards and be honest with yourself about what this actually looks like.

15. Mental impact:

When you dig deep into the truth behind your addiction, you can find out what is really bothering you in your life. It sounds so simple doesn’t it? Please be gentle with yourself at this point in your recovery, you didn’t get here over night so it’s going to take a while to build up some healthier coping mechanisms. Anxiety will be a normal reaction, get some professional assistance and join a support group – you are not alone or strange or weird or even that unusual.

Whilst your own life experiences that have brought you to this place are of course unique to you, addictive behaviour is common place, please never feel alone.

16. Stuff impact:

Think about all those notebooks you bought just because they were cute.

Are they collecting dust in the bottom drawer of your desk?

Don’t you feel suffocated with the lack of space you have for the essentials?

Beating your shopping addiction will bring you more space both mentally and physically.

You may even find that the pleasure of giving far out ways the pleasure you’ve been getting from making the purchase in the first place.

It can honestly be JUST as rewarding to SELL all that stuff that you have now mentally let go of – you might even make money on some of them!

17. Retirement impact:

These days, with financial movements like FIRE (Financial Independence Retire Early), people are rushing to invest their savings and invest money. Addressing your need to shop could mean that you will retire earlier.

18. When you have addressed the emotional – Look at the practical

Addiction is caused by the difficult feelings you feel, how you choose to deal with them, and how the addiction makes you feel afterward (source). The most effective way to deal with an addiction is to get to the root of the problem – this will fix the way you deal with your emotions.

In addition to learning how to cope with your emotions, there is a need to develop a solid plan that will stop you from doing the shopping. The plan will include practical tips for beating back compulsive buying and debt.

We have loads of free and super cheap downloads available in our shop that can help you to get organised. From simple printable budgets to more comprehensive debt tracking calculators, it’s (almost) everything you need to get on track with your finances.

- Calculators

- Checklists

- Debt Organizers

- Excel Downloads

- Just Budgets

- PDF Guides

- Printables

- Quotes

- Under $1

I have just started a new Etsy shop with LOADS of new tools that might help you to get on track too – please check it out HERE

Take practical steps for sustainable recovery

19. Look at your debts:

Take a moment to study the debts you have accumulated over years of compulsive spending. If you stop over buying now, you can save more money and pay off your debts. Check out these free debt worksheet that can help you deal with your finances here.

20. Make a budget:

Educate yourself on the importance of budgeting your money every month. List down the essentials that you need to pay for, and see how much money you have left. Don’t try to be perfect on the first try. Start with small steps. Click here to access some free printable budget worksheets.

21. Consider debt payment plans and consolidations:

Your shopping habit might have accrued debt into your life. To combat this, consider debt payment plans and consolidation programs. These are services that make debt payment a lot easier.

22. Be deliberate:

Commit to being more intentional and conscious with your spending. Remove excess expenditures from your budget. Learn to declutter and upcycle the things that you already have. Read about how to declutter, clean, and make a positive impact on the world.

23. Know it’s a journey, not a destination:

We all know of the 12 steps journey used in addiction groups like Alcoholics Anonymous and Spenders Anonymous. These steps provide a slow but steady guide to addressing compulsive disorders. Ease yourself into this journey – try not to jump feet first into the waters.

24. Seek more knowledge on addictions and compulsivity:

One of the best ways to learn about shopping addiction is to read research articles and books on the topic. There are also many blogs by people who used to have shopping addictions who have overcome their challenges and paid off their debt.

25. Connect with like-minded people online:

Join social media groups where like-minded people share their thoughts and experiences. There are also some great online programs that provide counselling for addictive behaviours.

26. Treat yourself:

Don’t beat yourself up for slipping up. Start with baby steps. Another tip is to plan your shopping treats ahead of time so that you don’t over-spend.

27. Have a back-up plan in place:

Right now, you might be pumped up and ready to kick this shopping addiction to oblivion. However, the smarter option would be to leave some room for failure. If you fall off, don’t be too mad at yourself. Come up with some activities to distract yourself from the temptation of buying new things.

28. Delete online shopping apps from your phone:

Almost all of your favourite stores have apps, making shopping a lot easier. It can be tempting to go on a shopping spree, what with the ease with which you can buy things online. A great option would be to delete the apps off your phone. This will stop you from compulsively buying things.

29. Go for therapy:

A shopping addiction can morph into something life-threatening. If you get the help you need, you stand the chance of beating this addiction and saving yourself from difficult situations. Find a therapist to help you work through your mental health issues. This can help you to live a healthier and happier life.

Elisa Bowman is a very good friend of mind and is truly excellent at counselling people through trauma and addiction – take a look at her page here and drop her a line, i’m sure she’d be more than happy to have a chat about what you need.

PROS of being in “Shopaholics Anonymous”

• Discussions with like-minded shopping addicts

• A platform to ask questions about your addiction

• Answer other’s questions based on your own experiences

CONS of being in “Shopaholics Anonymous”

• Temporary discomfort while you work through your issues

• The risk of getting offended by other’s opinions

Frequently Asked Questions

1. What do you call a person who is addicted to shopping?

Someone who keeps buying things they probably don’t need is called a shopaholic.

2. How do you know if you have a shopping addiction?

You have a shopping addiction if you go shopping or online shopping when you feel distressed. After shopping, you feel a rush of joy. If this is how you consistently deal with emotions, you may have a shopping addiction. It’s worse if you have to lie and cheat to get money to feed your addiction.

3. Why do I have a shopping addiction?

You have a shopping addiction because you cope with difficult emotions using shopping therapy. Identify the events that make you feel like shopping and replace shopping with healthier coping mechanisms.

4. How do you break a shopping addiction?

Dealing with a shopping addiction works by first identifying your shopping triggers. Do you reach for your Amazon app when your boss yells at you? Find better ways to deal with your difficult emotions like meditation or positive thinking.

5. Is compulsive shopping a mental disorder?

It is not officially a part of the Diagnostic and Statistical Manual of Mental Disorders (DSM). However, it might be a type of impulse control disorder or a behavioural addiction.

6. How is compulsive buying disorder treated?

Compulsive buying disorder is treated through behavioural therapy and individual counselling.

7. How do I break my spending addiction?

You can break your spending addiction by replacing it with other activities to divert your attention from shopping, for example, meditation, exercise, or painting.

8. Is compulsive shopping a symptom of depression?

Some people who compulsively shop may use it as a way to cope with depression.

9. Why does shopping make me happy?

Shopping can release dopamine in the brain. Dopamine is the happiness hormone.

10. What causes compulsive shopping?

Generally this happens when someone is addicted to shopping because it makes them feel joy although it can lead to psychological and social issues like depression and debt.

Conclusion

Shopping addictions are responsible for turning thousands of people into empty consumers obsessed with hoarding shiny new objects. Shopping addicts are medicating their stress and anxiety using an unhealthy habit – buying things they probably don’t even need. Worry not, because a shopping addiction can be reversed using a few healthy coping skills. Here are some starting tips for breaking this addiction:

- Go to therapy.

- Identify your triggers.

- Journal about why you shop and how you feel afterward

- Write down some affirmations to motivate you not to spend

- Meditate

- Organise all the stuff you have bought

Check out our posts about getting out of debt and organizing your budget. We have loads of free checklist and helpful tips to help you get your money sorted!

- All Things Budgeting

- Blog

- Credit cards and loans

- Plan Your Debt Exit

- Printables

- Quotes

- Side Hustels

- Small Business Tools

- The Tool Kit

- Upcycling and Renovation

Great books to read include:

Spent: Break the Buying Obsession and Discover Your True Worth – Sally Palaian Ph.D.

Recovery by Russell Brand (i have this on audible and have listened to it 3 times so far! I love it)

To Buy or Not to Buy: Why We Overshop and How to Stop – April Lane Benson

The Paradox of Choice: Why More is Less – Barry Schwartz

Getting Out from Going Under: Daily Reader for Compulsive Debtors and Spenders – Susan B.

Check out our posts about getting out of debt and organising your budget. We have loads of free checklist and helpful tips to help you get your money sorted!

- All Things Budgeting

- Calculators

- Credit Cards, Loans & Mortgages

- Downloads

- Kids & Money

- Plan Your Debt Exit

- Quotes

- Shopaholics

- Side Hustles

- Tips & Tricks