Avalanche Or Snowball? Which Debt Payoff Method Is The Best?

Avalanche or Snowball?

Which Debt Payoff Method is REALLY The Best??

There is so much misinformation out there in this avalanche or snowball debate – so which debt payoff method is REALLY the best – the avalanche debt payoff method or the snowball debt payoff? Any ideas?

Most people generally think that it’s the debt snowball……but…….before you throw loads of your hard earned money down the drain…….how would you like some actual proof for a change?

The following case study uses some sample financials (yes, actual real numbers!) to show you how paying highest interest first (the debt avalanche) vs lowest balance (the debt snowball) vs do nothing (the debt procrastinator!) has a huge impact on the interest fees that YOU get charged and how long it will take you to pay debts off in each method.

Choosing a debt payoff method can be even more important than how much money you have to pay them off with.

The wrong plan can end up costing you \$ / £ thousands more in interest, take you months or even years longer to achieve debt freedom and could even cause you to fall off the wagon entirely!!

Avalanche vs Snowball

To help you to choose which debt payoff method is best and to demonstrate how these systems work, we have created a very simple case study to show how having the same amount of debt and the same spare cash to pay it off with each month can have vastly different outcomes depending whether you choose the debt snowball or the debt avalanche.

In this example we are going to look at 3 people; Bob, Sally and Selina who by absolute coincidence have exactly the same amount of debt over the same 2 credit cards and each one of them can spare \$500 per month to improve their financial situation.

Bob with his savings account

(The Debt Procrastinator!)

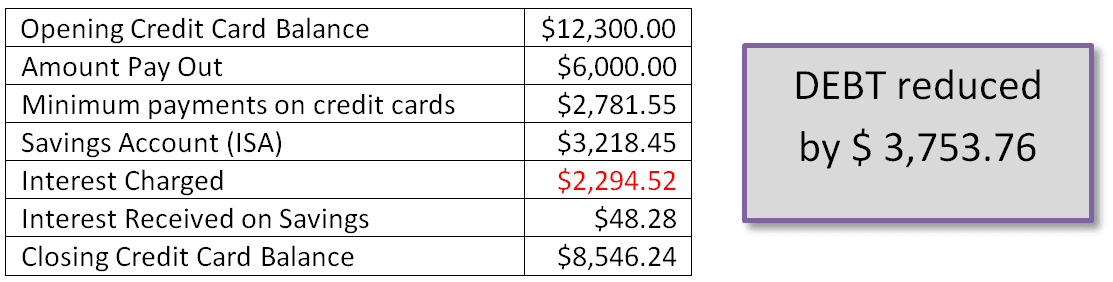

Lets start with Bob who has $500 each month to pay his cards and add to his savings so he pays the minimum payment (1.89% of the outstanding balance) off his cards each month and puts the rest of his available cash into an ISA @ 1.5%.

By the end of the year Bob has paid out a total of $6,000, which consisted of $2,781.55 into his credit cards, where he was charged $2,294.52 in interest. He paid $3,218.45 into his ISA which earned him $48.28 and at the end of the year decides to use his ISA and its interest to pay down his cards, this reduces his overall debt by $3,753.76 From $12,300 to $8,546.24.

So the totals for Bob’s 12 months looks like this:

Minimum Payments + Savings =

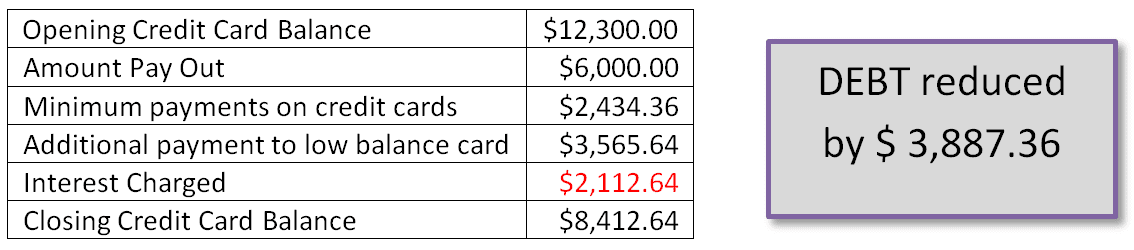

Sally’s Debt Snowball Method

Sally is in the same situation but instead of putting her spare money into low interest savings, she decides to pay it off her credit cards using the debt snowball method which means she has decided to throw all her spare money at the Super dooper number 2 card that has a balance of \$3,800.

At the end of the year Sally has paid out the same \$6,000 but it all went into her credit cards, she was charged \$2,112.64 in interest and has reduced her overall debt by \$3,887.36 from \$12,300 to \$8,412.64, almost completely paying off the lower balance card. That’s a $133.60 better than poor Bob for exactly the same outlay.

Debt Snowball Method =

Serena’s Debt Avalanche Method

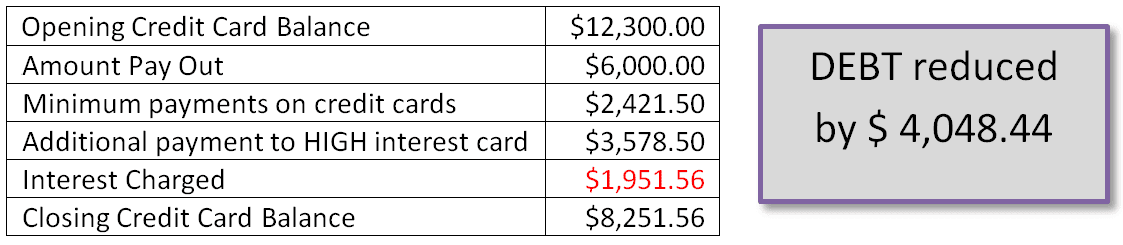

However Serena who is coincidentally in exactly the same situation as Bob and Sally, has decided to pay off her debts with the debt avalanche method and has started by paying down the Super amazing number 1 card as it has the highest interest rate. By the end of the year Selena has paid \$6,000 into her credit cards, she was charged \$1,951.56 in interest and has reduced her overall debt by \$4,048.44 from \$12,300 to \$8,251.56. That’s $294.68 better than Bob and $161.08 better than Sally, again for exactly the same outlay and that’s just a single years snapshot!

Debt Avalanche Method =

So, which will you choose? The Debt Avalanche or The Debt Snowball ??

Imagine for a moment that you have a debt that is higher than $12,300 and that the interest is being charged year after year after year compounding again and again until you pay it off. It’s a hell of a lot of money to pay out just to effectively stand still.

So the cost of inaction is high, you already know that, but look at how amazing it is when you act! This example shows just one year of payments and just a small increase in regular deposits, image that over a longer time span and if you are able to make lifestyle changes in the short term that enable you to pay off lump sums. The results have the potential to be amazing!

Here at Debt Help Tools we we’re working on a new tool that you will be able to use to track how lump sum and increased regular payments will affect your overall debt. Then we found a FREE on at vertex42 so we tested it out and found it to be absolutely brilliant! It’s really worth checking out their resources.

Debt Payments & Cashflow

Another point to note here is cash flow.

How we pay down our debts is basically finding a way for the debt to cost us as little as possible. I’m sure none of us would be particularly concerned if we had a pile of 0% debt and the equivalent amount of cash sitting in an investment account safely earning upwards of 5% would we?

So we want to maximise both the cash that we keep and the impact we are able to have on our debt, so in addition to the interest rate assessment that we have just done, we need to look at the minimum payment % too.

If one of your cards has a reasonable low interest rate but they are asking for a high % as a minimum payment amount, that’s really going to have an impact on cash flow, especially if you have only a limited amount to throw at the entire debt on a monthly basis.

The following video explains this really well…..

Ready to see how this might work with your debts?

The first step will be to get organized and take a good look at all your debt on one place.

The simplist was to do this would be with our free debt calculator. This sheet will enable you to list all your debts, interest rates and assets in a really simple way, it will also work out your debt to asset ratio and show you the loan to value (LTV) rate on your house. If you use this together with the budget calculator, you will be able to work out how much you can use each month towards your debt payments.

If you just want access to a quick “what if” for your debts in the snowball method, undebt.it do a great one that’s free to use – try it HERE.

If you are already in a place where you know your debts but you need to get more organised with HOW you can pay them off for the best possible result then I would highly recommend Vertex42’s debt reduction calculator.

I’m a huge believer in not reinventing the wheel so i have downloaded and tested out their calculator to see how it works in detail and its really good! They also have a great “how to” video next to the download button. Also it’s free so all you have to lose is a little bit of time which could potentially save you THOUSANDS if you can pay your debts off faster with less interest charges.

If you go to their home page you will see a huge selection of templates – FOR FREE!! to get to the debt payoff calculators, navigate down the right hand side of the home page under “browse template categories”, select “debt payoff” and the first calculator in the list – the “debt reduction calculator” is the one you want.

Before you move forward with any solution or payment method, be it debt consolidation, a re-mortgage, credit card transfers or anything else, you need to see where you stand and thus be able to evaluate your options accordingly.

You might like to look at our “7 simple steps to debt freedom” or download some of our checklists to help you get on track.

As we are continually developing the tools that we offer here, if you do decide to use any of our tools, we’d be really gratefull for your feedback.

Why not get in touch with comments or suggestions for content that you would like to see.

Snowball or Avalanche?

So which will you choose?

Paying off debts is a daunting business but it’s an amazing feeling!

whether you choose the debt snowball or the debt avalanche, you need to give yourself a pat on the back for getting this sorted and not being a Debt Procrastinator!

Don’t forget, if this is all feeling just a bit too much – that’s perfectly normal!!

Check out our post on money mindset – it might help you out!

Do you think it matters how we think about money??

Let me ask you this; can you image that anyone ever got rich AND stayed that way by disliking money? If you don’t like, want or care for it, then whatever omnipotent being you believe in, (or simply your own limiting belief that you don’t deserve it) will doubtless do your bidding and take it away. Do you want to get AND keep more money? Then start to LOVE it!!

Avalanche Or Snowball? Which Debt Payoff Method Is The Best? Read More »