Frugal Living for Shopaholics

Shopaholics, rejoice! It’s possible to embrace frugal living while indulging in your love for shopping. All it takes is a change in mindset and the determination to adopt more mindful and deliberate spending habits.

This is not about depriving yourself. Rather, it is about becoming more aware of how and where you spend your money to enjoy financial freedom and stress-free living. Building a frugal lifestyle starts with your values and priorities. Determining what is truly important to you makes it easier to stop compulsive spending.

This article will give you 29 tips for changing your shopping habits, even if you are a shopaholic. Moreover, you can find sustainable, affordable alternatives with these tips.

To keep you on track, we will also cover effective money-saving tools, techniques, and tips on overcoming challenges you may face. Changing your spending habits, giving up shopping. Just get the right mindset and determination to Cut the Budget.

Key Takeaways

- Establish a strong foundation based on personal overcoming ties for mindful spending habits.

- Discover worldwide applicable tips and sustainable alternatives that cater to shopaholics.

- Consistency in frugal living is achievable through effective tools, techniques, and overcoming challenges.

The Foundation of Frugal Living

Understanding Frugality

Frugality means living within your means and making conscious, deliberate choices about spending money. It’s not about depriving yourself of everything you enjoy but about finding the right balance between spending and saving. By adopting a frugal mindset, you can identify areas where you can save money and enjoy your favourite activities.

The Importance of Budgeting

Creating and sticking to a budget is an essential part of frugal living. A budget helps you see where your money goes each month and allows you to re-evaluate your priorities. First, list your essential expenses, such as rent, utilities, and groceries. Next, allocate money for discretionary spending, including shopping, entertainment, and dining out. Remember to include a category for saving and paying debt. After you figure out how much you spend in each category, you can make changes to reduce expenses.

This will also let you focus your money on your most important goals, such as paying off your debts or saving for a rainy day.

Setting Financial Goals

Establishing clear financial goals is an effective way to curb compulsive spending habits.

Financial goals could be short-term (e.g., saving for a holiday) or long-term (e.g., buying a house). Setting and breaking down your goals will motivate you to stay within budget. As a result, you will make wise spending choices.

Debt Management

For shopaholics, managing debt is crucial for achieving financial freedom. Credit card debt, particularly, can accumulate quickly with high-interest rates.

First, you need to list all your debts, paying attention to their interest rates and least payments.

Pay off your highest-interest debt first while still paying minimums on everything else. (otherwise known as the avalanche method)

Once that debt is cleared, move on to the next highest interest rate. This approach, the avalanche method, can save you money on interest in the long run.

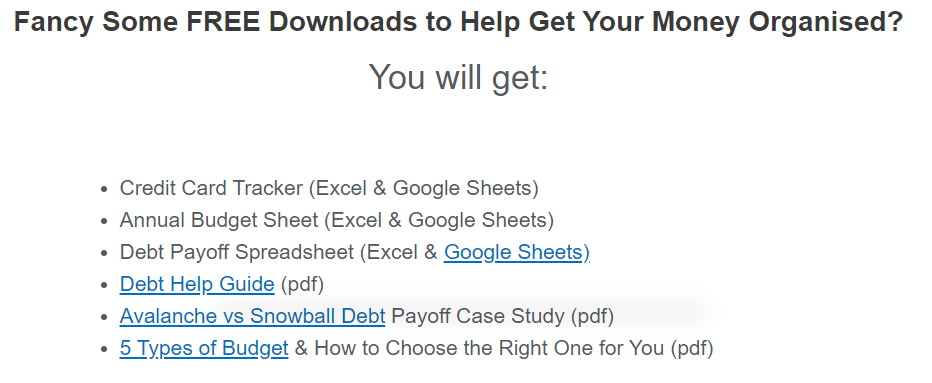

I’ve even made a cool little debt tracker spreadsheet for you to work this out.

Throughout your journey towards frugal living, remember to be patient with yourself and celebrate small victories.

Changing habits takes time, but the rewards will be worth it as you gain control of your finances and achieve your goals.

Creating a Frugal Lifestyle

Mindful Shopping Habits

To create a frugal lifestyle, it is essential to develop mindful shopping habits.

Always make a list before you go shopping, and stick to it.

This helps you avoid spontaneous purchases and ensures you only buy what you need.

Also, consider using cash instead of cards when shopping, making tracking your spending easier, and giving you the oportunity to get cashback on your spending.

To save even more on groceries, try buying store-brand products and shopping at discount stores, or use sites like topcashback if you’re shopping online and get a nice little kickback on your spending.

You can save much money on meals by cooking at home instead of dining out. Plan your meals, and use grocery store discounts to your advantage.

If you want to save more, consider meal prepping and cooking in larger portions, which can be cheaper. Additionally, using a water filter instead of buying bottled water can help cut costs.

Cutting Utility Bills

Reducing your utility bills is another excellent way to save money.

To lower water usage, fix leaks in your home and consider installing a low-flow showerhead.

For gas and electricity, regularly compare providers to ensure you’re getting the best deal. Infact – if you are in the UK, get in touch with my friend Berns, she’s awesome at sorting out great utility deals for people!

Lastly, cancel any subscriptions you do not use, like magazines or streaming services. You might want to track them in a simple spreadsheet so that you know when the renewal is due – there is nothing worse than seeing a chunk of money leave your account for something you signed up for a year ago and never used!

Transportation

Consider alternative methods of transportation to save money. Walking or cycling are not only free but also promote a healthy lifestyle. If walking or cycling isn’t possible, try using public transport instead of driving your car. To save further on travel, organize carpools with friends or co-workers.

Entertainment on a Budget

Finding low-cost or free entertainment can be a fun and exciting way to save money. Attend free concerts and community events or visit local museums on free admission days. Additionally, consider hosting a potluck dinner or movie night with friends rather than going out. Remember, with a little creativity, entertainment doesn’t have to break the bank!

Voucher sites are awesome for getting low costs deals on all kinds of activities – absolutly worth checking out before you spend anything.

Effective Money Saving Tools

Budgeting Applications

Many budgeting apps are available to help you track your income and expenses.

These user-friendly tools offer a clear picture of your financial habits to identify areas where you’re overspending. Popular apps like Mint and You Need A Budget (YNAB) can connect to your bank accounts and credit card statements to automatically update your transactions and create personalized budgets based on your income.

Regularly reviewing your budget will keep you mindful of your spending and, ultimately, create healthier habits.

Apps are not for everyone though, I’ve always been a bit of a spreadsheet girl at heart – hense all my budget spreadsheets in the template shop! But i have started using PocketSmith in the last year or so and am finding it really good!

Investing and Retirement Savings

Budgeting for the future will teach you to rank spending over impulsive purchases. Invest in stocks and bonds. Some investing applications, such as MoneyBox and Vanguard.

I’ve just started investing in InvestEngine as they were recomended by one of my favourite financial youtubers – so far it’s going well, they even gave me a £25 sign up bonus!

Moreover, retirement savings accounts such as pension plans are important for financial stability. By contributing regularly, you can make a significant difference to your retirement income.

I did a little case study on that if you want some more evidence as to why thats a good thing.

Credit Card Rewards

Responsibly using credit card rewards schemes can help benefit your finances in the long run.

Take advantage of cashback offers, discounts, and points systems to maximize returns on your necessary purchases.

However, treat these rewards as bonuses rather than primary spending reasons.

Always pay off your credit card balance in full each month to avoid high interest rates and unintentional debt. Regularly assessing your credit card choices will ensure you are reaping the rewards most suitable for your finances.

If you are looking for a comprehensive guide to shopaholic tips. In that case, you must check out ‘Shopaholics Anonymous – 29 Tips for the Recovering Shopaholic,‘ We delve into strategies to overcome compulsive shopping habits.

Practical Tips for Shopaholics

Clothing and Fashion

It’s essential to prioritize your clothing needs and only buy items that serve a purpose. When shopping for clothes, consider the following tips:

- Shop during sales or at discount stores to save on high-quality items.

- Avoid buying trendy items that will quickly go out of style and opt for timeless pieces instead.

- Swap or borrow clothes from friends and family to refresh your wardrobe without spending.

- Mend or alter items in your closet before deciding to purchase something new.

Grocery Shopping

You can save a significant amount on your grocery bills by adopting the following mindful shopping habits:

- Make a shopping list before visiting the store and only purchase items on the list.

- Buy vegetables and other perishables in smaller quantities to avoid waste.

- Collect and use coupons to save on everyday items.

- Purchase non-perishable items in bulk for a lower price per unit.

- Do a price comparison between different supermarkets to find the best deals.

- If available, grocery delivery can save time and fuel costs, but take advantage of free delivery promotions.

Online Shopping

It’s vital to foster discipline when shopping online since it’s easy to fall into buying impulsively. Here are some tips to curb your online shopping habits:

- Remove saved payment information from online retailers to make it more challenging to complete a purchase.

- Set a budget for monthly online expenses and avoid exceeding this limit.

- Compare prices across websites before buying and track price drops for items on your wish list.

- Use money-saving browser extensions that find coupons or cashback when shopping.

- Unsubscribe from marketing emails to reduce the temptation to shop.

- Consider whether having an Amazon Prime subscription is necessary, as it might encourage impulsive buying. If it’s not essential for your needs, cancel the membership to save on monthly charges.

I particularly like this “5 Money Tips From a Frugal Shopaholic guide.” It is worth a read!

DIY and Sustainability in Frugal Living

Home and Garden

Creating your cleaning products can save money and reduce waste. Try using vinegar, baking soda, and lemon as natural cleaning agents. For your garden, grow your herbs and vegetables, which can be a cost-effective way to have fresh produce. Additionally, gardening can be a therapeutic hobby that helps curb your urge to shop.

Food and Beverages

A well-stocked pantry can help you save money on meals. Make a meal plan based on the items you already have, and use a shopping list when you go to the store to avoid impulse purchases. Cook in bulk and freeze leftovers for later use. To minimize food waste, repurpose your leftovers into new meals or compost what you can’t use. Visit your local library for recipe books and other resources on frugal cooking.

Some tips for saving money on food and beverages include:

- Cooking at home instead of eating out

- Buying food in bulk when it’s more cost-effective

- Using discount grocery stores

- Utilizing coupons and loyalty programmes

If you’re looking for effective frugal living tips for families, be sure to check out our comprehensive guide on cutting the budget.

Beauty and Personal Care

Consider DIY solutions for beauty and personal care products.

For example, you can make laundry detergent using basic ingredients like washing soda, borax, and bar soap.

This not only saves money but also reduces plastic waste. This is tbh a step too far for me but I do use SMOL (UK only i think) but worth a look if you want to save money and your environment.

You can make other beauty products using natural ingredients like face masks, scrubs, and even toothpaste. These more sustainable practices will create a healthier home environment while saving money.

Remember, living frugally doesn’t mean sacrificing your well-being or the things you love. Instead, it’s about adopting more mindful and deliberate spending habits, ultimately leading to a more satisfying and fulfilling life.

Overcoming Challenges to Frugal Living

Living Paycheck to Paycheck

Breaking the habit of living paycheck to paycheck can be challenging, especially for shopaholics.

However, by managing your finances better, you can achieve a more sustainable way of living.

One method is to create a monthly budget and stick to it. To ensure you save more, consider allocating a portion of your income to an emergency fund.

I’ve done a bit of work to understand which budgets are the most popular and put them into a little ebook that might be worth a read if you are new to this budgetting thing.

When planning your food budget, consider unit prices and choose cost-effective ingredients like beans. They are economical and a healthy, sustainable source of protein. Moreover, planning your meals can help ensure your family’s expenditure stays within the budget.

Dealing with Unnecessary Expenses

Identifying and cutting down on unnecessary expenses allows you to make significant savings.

Start by distinguishing between your needs and wants. This could mean cutting back on eating out, travelling, or buying items that are not essential. Look for affordable alternatives or engage in free activities that match your interests.

Wherever possible, avoid late fees and missed payment charges by staying organized and paying your bills on time. Set up payment reminders or use a calendar to ensure timely payments. Implementing these suggestions should help you reduce your overall expenditure, allowing you to divert funds to more essential areas.

Recessions and Economic Factors

Mindful and deliberate spending habits are even more crucial during a recession or an economic downturn.

These periods may affect job security, making it crucial to save money and avoid debt where possible. That’s easier said than done though!

Plan your food budget carefully, and consider growing a small garden to supplement your grocery budget. Although inflation may affect the cost of goods and services, shopping around for the best deal and being aware of sales can help you save money.

Furthermore, developing new skills can aid you in remaining employable on rainy days, and give you something construcive to do which is a great distraction from shopping and helps considerably with mental health, especially in tough financial times.

With these tips and more mindful spending habits, you’ll be better prepared to deal with shopaholic challenges.

Achieving Stress-Free, Frugal Living

Financial Freedom

Embracing frugal living can lead to financial freedom, significantly reducing stress levels.

You’ll have more control over your money by cutting unnecessary expenses and focusing on what truly matters.

To start, create a budget that outlines your essential and non-essential expenditures.

This will give you a clear picture of your spending habits, allowing you to identify areas where you can save. Track your spending and continuously update your budget to maintain financial awareness.

Practising mindful shopping can greatly impact your financial freedom.

Before making any purchases, ask yourself if it’s necessary and if it brings genuine value to your life. Consider delaying non-essential purchases to help curb impulsive spending.

Positive Lifestyle Changes

Frugal living encourages positive lifestyle changes, fostering a sense of fulfilment.

Don’t be afraid to participate in activities that cost little to no money, like nature walks, picnics, or volunteering. Again – check voucher and special deal sites before you book anything, it really is amazing what you can find!

You can use reusable bags, buy energy-efficient appliances, and repurpose old items instead of buying new ones.

Follow these frugal living tips to achieve financial freedom and live a more content and fulfilling life. For more insights into managing your finances wisely, check out the importance of budgeting.

Conclusion

Ensure you develop a realistic budget for investments, wealth creation, and financial objectives.

You can eliminate shopaholic tendencies by following these frugal living tips. These changes will likely result in significant savings, lower expenses, and financial freedom.

Frugal living does not require you to deny yourself all pleasures but to find a healthy balance and make smart choices.

Keep an eye on your spending triggers and prioritize needs over wants. Ensure you develop a realistic budget for investments, wealth creation, and financial objectives.

Also, think about buying second-hand, swapping, or sharing stuff. It’s a huge world of frugal living, and there are many strategies to suit everyone.

These practices will help you build a better relationship with money, reduce debt, and get ahead financially.

It’s important to stay positive during your frugal living journey. Celebrate your achievements with those who share your goals. You’re more likely to enjoy financial freedom if people like you surround you!

You’ll see a difference in your finances as soon as you commit to a frugal lifestyle. Don’t give up! Keep learning and adapting, and remember, with perseverance and dedication, you’re on your way to frugal living.

Frequently Asked Questions

What are effective strategies to control compulsive spending habits?

To control compulsive spending habits, you can try implementing the following strategies:

- Recognize your spending triggers: Identify the situations or emotions that typically lead to compulsive shopping and try to avoid them.

- Implement the 30-day rule: If you see something you want to buy, wait 30 days before purchasing. This allows you time to think about whether you genuinely need the item.

- Unsubscribe from marketing emails and social media advertisements: Limit your exposure to marketing content that encourages spending.

- Use a list before shopping: Create a list of things you need and stick to it. This can help prevent impulsive purchases.

Which frugal living tips can help shopaholics adopt more mindful spending?

Some frugal living tips for more mindful spending include:

- Shopping at thrift and discount stores: Buying second-hand or discounted items can save money.

- Setting a monthly spending budget: Allocate a specific amount to non-essential items each month. This helps you stay conscious of your spending habits.

- Researching and comparing prices: Before purchasing, ensure you get the best possible deal by researching different retailers and their prices.

How can tracking expenses help shopaholics save money?

Tracking your expenses allows you to gain a better understanding of your spending habits. Regularly reviewing your expenditure can identify areas where you can cut back or make adjustments. This process encourages you to be more accountable for your spending decisions, which can ultimately help you save money.

What role does setting financial goals play in managing compulsive spending?

Setting financial goals, such as saving for retirement or a large purchase, can provide a strong motivation to manage compulsive spending. Having a specific financial target encourages you to reassess your spending habits and make wise decisions to help you reach your financial objectives.

Can shopping bans contribute to frugal living for shopaholics?

Yes, shopping bans can be an effective tool in promoting frugal living for shopaholics. Shopping bans involve restricting yourself from purchasing non-essential items for a set period. This can help you break the compulsive spending habit, re-evaluate your priorities, and save money.

How does ‘value over quantity’ relate to frugal living?

The idea of ‘value over quantity’ emphasizes the importance of making purchases based on the long-term value of the item rather than simply acquiring a large number of possessions. By focusing on finding quality items that are durable and serve a purpose, you can minimize your expenditure while also enjoying the benefits of a more clutter-free, organized life.