Debt Management Planning Tools

Are you struggling with debt and looking for ways to manage it effectively? Whether you’re dealing with personal finance or running a small business, debt management can be a daunting task. But with the right tools and strategies, you can take control of your finances and work towards becoming debt-free.

In this comprehensive blog post, we’ll cover a wide range of debt management tools and techniques that can help you pay off your debts faster, lower your interest rates, and create a customised repayment plan that works for you. From debt payoff calculators and budgeting software to debt consolidation and repayment plans, we’ll explore the best debt management tools available for both the UK and US markets.

Managing your debt can be overwhelming, but it doesn’t have to be. With the right mindset and tools, you can take charge of your financial situation and work towards achieving your debt payoff goals. So, let’s dive in and explore the world of debt management tools and techniques, and discover how they can help you become debt-free.

Debt Management Strategy

When it comes to managing debt, having a solid strategy is key. Here are some sub-sections to consider when creating a debt management plan.

Before You Payoff Any Debt…

Before you start paying off any debt, it’s important to take stock of your financial accounts and credit report. This will give you a clear understanding of how much you owe and to whom, as well as your credit score and credit utilization. By knowing this information, you can create a plan that is tailored to your specific financial situation.

I’ve created a load of spreadsheets over the years – each one was was intended to get me more organised than the last…!

A spreadsheet is unfortunatly only as good as the data you put into it, so keeping it simple but making sure that it tells you an accurate stroy about your money is key to making this work.

I’ve made a few credit card trackers and budget sheets that you might find useful for this part of your journey, especially my little credit card tracker with charts…

This Custom built interest calculator lets you list your credit cards or loans with their outstanding balance and the amount of interest you have been charged for that month. The calculator will then return the annual interest rate that you are being charged. This is especially useful when you are deciding which of your debts to pay down 1st (tip – the most expensive!!)

Creating a Debt Reduction Strategy

Once you have a clear understanding of your debt and credit situation, it’s time to create a debt reduction strategy. This should include a plan for paying off your debts in a way that makes sense for your financial goals and budget. Consider using a debt payoff planner or calculator to help you determine the best approach.

Lower Interest Rate

One way to pay off debt faster is to lower your interest rates. This can be done through negotiating with credit card companies or by consolidating your debt. By lowering your interest rates, you’ll be able to put more money towards paying off the principal balance.

Debt Reduction Plan

A debt reduction plan is a specific plan for paying off your debt. This plan should include a list of your debts, the interest rates, and the minimum monthly payments. You can then prioritize your debts based on the highest interest rate or the smallest balance. Consider using the debt snowball or debt avalanche method to help you pay off your debt faster.

Debt Consolidation

Debt consolidation is the process of combining multiple debts into one loan with a lower interest rate. This can be a good option for those with high-interest credit card debt. However, it’s important to do your research and make sure you’re getting a good deal before consolidating your debt.

Create a Customized Debt Plan

Creating a customized debt plan is key to successfully paying off your debt. This plan should take into account your income, expenses, and financial goals. Consider automating your debt payments and setting up payment reminders to help you stay on track.

Use a spreadsheet or an online tool that can give you a good idea of what your target looks like, how far away it is and what impact small payments can have in the longer term.

I have a built little calculator that can show you how just an extra few dollars / pounds / euros etc added to your regular payment can really impact the time it takes to get debt free and the interest that you pay by the end.

Try it out online or download it for later – I promise you will be suprised!

Money to Put Towards Your Debt

Finding extra money to put towards your debt can be a challenge. Consider cutting back on expenses, increasing your income, or using windfalls such as tax refunds or bonuses to pay off your debt faster.

No suprise here, I made a spreadsheet for that…I am getting predictable yet??

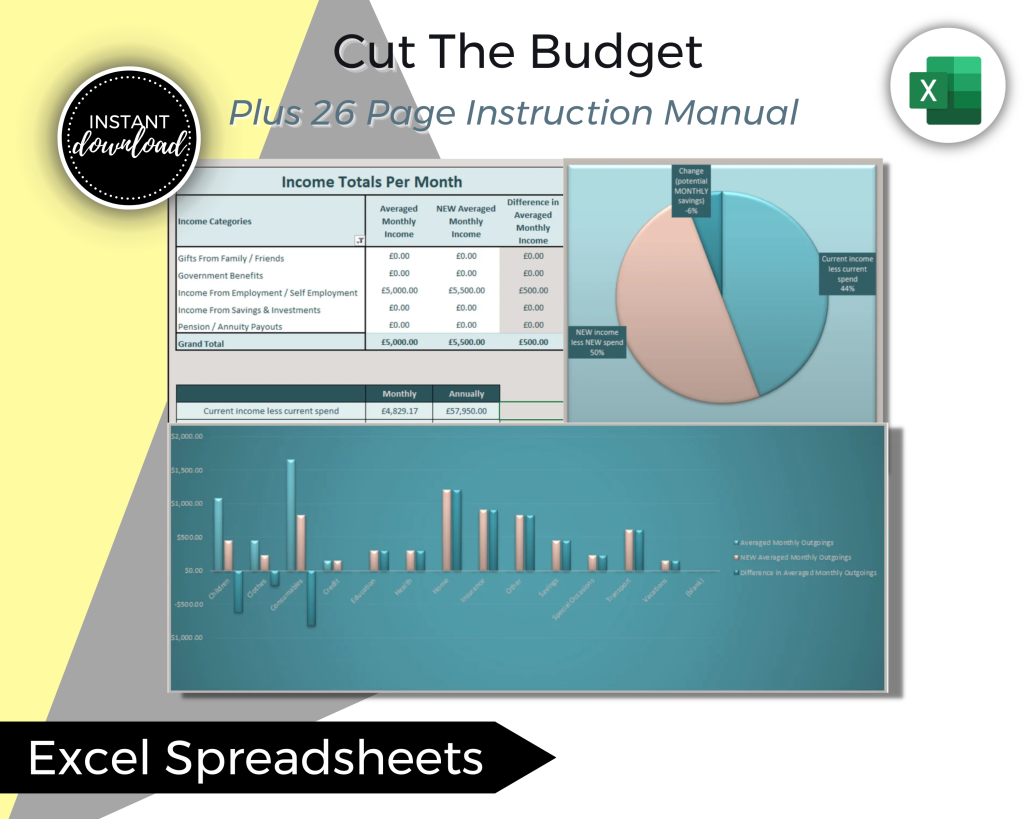

This sheet shows you side by side what your current budget looks like and what your “potential” budget could look like, let me explain..

If you have a clear view of all your expenses and income on one side and on the other you can cut some off your sky / cable bill, reduce your grocery spending by 10%, cancel a few subscriptions etc – this sheet will show you how much of an impact these changes will make on a weekly, monthly and annual basis – cool eh?

It takes your spend & income & instantly shows you exactly where your money is going by week, month & year

It will show you how much you really need to make ends meet and what you can do to get so much more out of what you already have.

There is even a 26 page manual on how to use it spep by step…!

This version of the budget planner allows you to put in both your spend and income TODAY and what you might be able to adjust it to going forward.

Repayment Plan

A repayment plan is a specific plan for paying off your debt over time. This plan should include a timeline for paying off each debt, as well as a plan for how much you’ll pay each month. By sticking to a repayment plan, you’ll be able to pay off your debt faster and more efficiently.

By following these debt management tools and strategies, you can take control of your debt and work towards becoming debt-free. Remember to stay disciplined and committed to your plan, and don’t hesitate to seek professional help if needed.

Debt Management Tools

If you’re struggling with debt, there are a variety of debt management tools available to help you get back on track. Here are some of the best debt management tools to consider:

Debt Management Software

Debt management software is a great tool to help you stay on top of your finances. With debt management software, you can track your spending, create a budget, and monitor your progress towards your debt payoff goals. Some of the best debt management software options include Quicken, ZilchWorks, and Undebt.it.

I use “Pocketsmith” for my personal accounts and “Freeagent” for my businesses. These are both great tools but they do take a bit of getting used to. If you don’t have the time or the inclination, using a spreadsheet for a while until you feel the need for a more tech based solution could be the way to go.

Excel Debt Payoff Planner

If you prefer to use Excel, you can create your own debt payoff planner. This allows you to create a customized plan based on your debt and repayment goals. You can use an Excel template or create your own spreadsheet to track your progress.

Printable Debt Planner

If you prefer to use pen and paper, a printable debt planner can be a great option. You can find free debt planner templates online or create your own. This allows you to track your progress towards your debt payoff goals and stay on top of your finances.

Making debt payoff into a bit of a game really does help a lot of people and there are loads of options available on Amazon & Etsy, you are sure to find one that works for you if spreadsheets & software apps are not your thing.

Track Your Progress

No matter what debt management tool you use, it’s important to track your progress. This allows you to see how far you’ve come and stay motivated to continue paying off your debt. You can use a debt payoff calculator to see how long it will take you to become debt-free, and track your progress towards that goal.

Different Payoff Methods

There are several different debt payoff methods you can use to pay off your debt. The debt snowball method involves paying off your smallest debt first, while the debt avalanche method involves paying off your debt with the highest interest rate first. You can also consider debt consolidation, which involves combining all of your debts into one loan with a lower interest rate.

Debt Management Plan

If you’re struggling to pay off your debt, a debt management plan can be a great option. This involves working with a credit counseling agency to create a repayment plan that works for your budget. The credit counseling agency will work with your creditors to lower your interest rates and create a payment plan that you can afford.

Remember, there are many debt management tools available to help you get out of debt. Whether you choose debt management software, an Excel debt payoff planner, a printable debt planner, or a debt management plan, these tools can help you pay off your debt faster and become debt-free.

Money Management

Managing your money is an essential part of debt management. It is important to create a budget and track your spending to ensure that you are using your money wisely and making progress towards paying off your debt.

Creating a Budget

Creating a budget is the first step towards managing your money and paying off your debt. A budget is a plan that helps you manage your money by tracking your income and expenses. It helps you identify areas where you can cut back on spending and allocate more money towards paying off your debt.

To create a budget, start by listing all your sources of income and your monthly expenses. This includes your rent or mortgage, utilities, groceries, transportation, and any other bills or expenses you have. Once you have a clear picture of your income and expenses, you can determine how much money you have left over each month to put towards your debt.

Track Your Spending

Tracking your spending is another important step towards managing your money and paying off your debt. It helps you identify areas where you are overspending and make adjustments to your budget. There are many tools and apps available that can help you track your spending, such as Mint or YNAB.

When tracking your spending, be sure to categorize your expenses so you can see where your money is going. This will help you identify areas where you can cut back and allocate more money towards paying off your debt. For example, if you notice that you are spending a lot of money on eating out, you can make adjustments to your budget and start cooking at home more often.

Overall, creating a budget and tracking your spending are essential steps towards managing your money and paying off your debt. By doing so, you can identify areas where you can cut back on spending and allocate more money towards paying off your debt.

Debt Payoff Methods

When it comes to paying off debt, there are several methods you can use to help you reach your goals. In this section, we’ll explore some of the most popular debt payoff methods and how they can help you become debt-free.

Debt Snowball

The debt snowball method is a popular way to pay off debt. With this method, you focus on paying off your smallest debt first, while making minimum payments on your other debts. Once you’ve paid off your smallest debt, you move on to the next smallest debt. This method can be effective because it gives you a quick win and helps build momentum as you work towards paying off your larger debts.

Debt Avalanche

The debt avalanche method is another popular way to pay off debt. With this method, you focus on paying off your debt with the highest interest rate first, while making minimum payments on your other debts. Once you’ve paid off your highest interest debt, you move on to the debt with the next highest interest rate. This method can be effective because it can save you money on interest in the long run.

Custom Plan

If neither the debt snowball nor the debt avalanche method works for you, consider creating a customized debt payoff plan that works for your unique situation. This could involve prioritizing your debts based on factors such as interest rate, balance, or creditor.

Debt Payoff Goals

Setting debt payoff goals can help you stay motivated and focused on becoming debt-free. Consider setting specific, measurable goals for paying off your debt, such as paying off a certain amount of debt by a certain date.

Payment Reminders

Setting up payment reminders can help you stay on track with your debt repayment plan. You can use a calendar or a budgeting app to set reminders for when your bills are due, or you can set up automatic payments to ensure that you never miss a payment.

Automate

Automating your debt payments can help you stay on track with your debt repayment plan and avoid late fees. You can set up automatic payments through your bank or credit card company to ensure that your payments are always made on time.

By using these debt payoff methods and tools, you can work towards becoming debt-free and achieving your financial goals. Remember to track your progress and adjust your plan as necessary to ensure that you stay on track towards your debt-free future.

Credit Report

Your credit report is an important tool for managing your debt and staying on top of your finances. It provides a detailed overview of your credit history, including your credit score, credit utilization, and information on credit bureaus and credit card companies.

Credit Score

Your credit score is a number that represents your creditworthiness. It is based on your credit history and helps lenders determine how likely you are to repay your debts. A higher credit score can lead to lower interest rates and better loan terms, while a lower credit score can make it more difficult to obtain credit.

Credit Utilization

Credit utilization is the amount of credit you are using compared to your total credit limit. It is an important factor in determining your credit score, as high credit utilization can indicate that you are relying too heavily on credit. To improve your credit score, it is recommended to keep your credit utilization below 30%.

Credit Bureaus

Credit bureaus are companies that collect and maintain information on your credit history. In the UK, the three main credit bureaus are Equifax, Experian, and TransUnion. In the US, the three main credit bureaus are Equifax, Experian, and TransUnion. You can request a free copy of your credit report from each bureau once a year.

Credit Card Companies

Credit card companies are the lenders that provide credit cards and other forms of credit. They report your credit history to the credit bureaus, which affects your credit score. It is important to make your payments on time and keep your credit utilization low to maintain a good relationship with your credit card companies.

Overall, your credit report is an essential tool for managing your debt and staying on top of your finances. By understanding your credit score, credit utilization, credit bureaus, and credit card companies, you can make informed decisions to improve your credit and achieve your debt payoff goals.

Frequently Asked Questions

What are the best debt management tools for personal finance and small businesses?

When it comes to managing debt, there are various tools that can help you stay on track. Some of the best debt management tools for personal finance and small businesses include debt payoff planners, budgeting software, and debt consolidation services. These tools can help you create a customized plan to pay off your debt, track your spending, and lower your interest rates.

What is the most effective debt payoff plan for both personal finance and small businesses?

The most effective debt payoff plan for personal finance and small businesses is the debt snowball or debt avalanche method. The debt snowball method involves paying off your smallest debts first, while the debt avalanche method involves paying off your debts with the highest interest rates first. Both methods can help you pay off your debt faster and stay motivated to reach your debt payoff goals.

How can debt management software help with budgeting and money management?

Debt management software can help with budgeting and money management by providing you with a clear overview of your financial accounts and debt repayment plan. This software helps you track your progress and stay on top of your debt payments. With features like payment reminders and custom plans, debt management software can help you stay organized and in control of your finances.

What are the benefits of using a debt payoff calculator for personal finance and small businesses?

A debt payoff calculator can help you create a repayment plan that works for your personal finance or small business needs. By inputting your debt information, interest rates, and payment amounts, you can see how much you will need to pay each month to become debt-free. A debt payoff calculator can also help you compare different payoff methods and determine which one is right for you.

How can a debt management plan help individuals and small businesses get out of debt faster?

A debt management plan can help individuals and small businesses get out of debt faster by consolidating their debts into one manageable monthly payment. With a debt management plan, you can negotiate lower interest rates and fees with your creditors, which can help you save money in the long run. Debt management plans also provide you with a clear repayment plan and help you stay on track with your payments.

What are the advantages of debt consolidation as a debt management tool for personal finance and small businesses?

Debt consolidation can be a useful debt management tool for personal finance and small businesses as it allows you to combine multiple debts into one monthly payment. This can simplify your finances and lower your interest rates, making it easier to pay off your debt. Debt consolidation can also help you avoid missed payments and late fees, which can negatively impact your credit score.