How to Stop Compulsive Shopping

How to Stop Compulsive Spending

Recognising spending triggers and knowing what you can do about them when they hit is critical to getting free from the mental and financial trap that is commonly known as compulsive buying disorder.

Do you find yourself succumbing to the irresistible urge to shop, even when you know that you either don’t need it and/ or you really don’t have the money for it? You’re not alone. Compulsive shopping, also known as compulsive buying disorder or shopping addiction, affects many individuals worldwide. It’s a challenging habit to break, but with the right strategies and a friendly guide, you can regain control over your finances and overcome this addiction.

Recognizing Compulsive Shopping

The first step in overcoming compulsive spending is recognizing the signs. Here are some common indicators that you might be struggling with this habit:

Frequent Impulsive Buying

Do you often find yourself purchasing items you don’t need on a whim, without careful consideration? Compulsive spending often involves impulsive purchases that can lead to financial strain and cluttered homes.

Financial Stress

Are you experiencing financial difficulties due to excessive spending and credit card debt? Compulsive spending can have severe financial consequences, including mounting debt and strained budgets.

Emotional Triggers

Do you turn to shopping as a way to cope with stress, anxiety, or other emotions? Many individuals use compulsive spending as a temporary escape from life’s challenges, but it often exacerbates emotional distress in the long run.

Harmful Consequences

Have your spending habits led to legal problems, strained relationships, or negative impacts on your well-being? Recognizing the harmful consequences of compulsive spending is a crucial step toward change.

If any of these signs resonate with you, it’s time to take action and regain control.

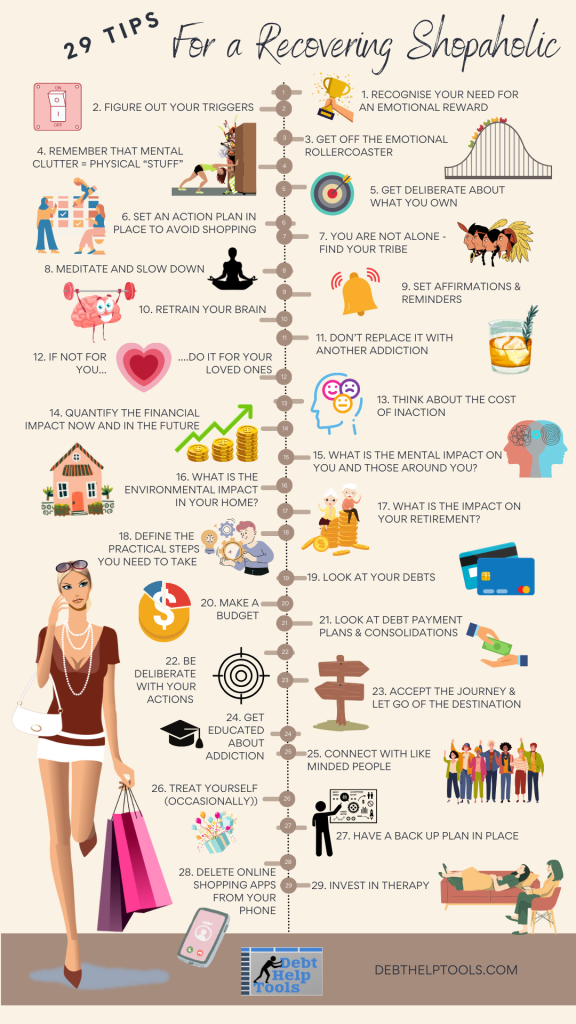

Strategies for How to Stop Compulsive Shopping

Learning how to stop compulsive and adictive behaviours is very much about the journey – not the destination. Knowing what to do ismn’t rocket science but doing it regularly – even when it gets really tough – thats where the magic happens.

1. Create a Budget and Stick to It

One of the most effective ways to curb compulsive spending is to establish a realistic budget. Here’s how to get started:

Track Your Spending

Begin by tracking all your expenses for a month. This will help you understand where your money is going and identify areas where you can cut back.

Set Financial Goals

Define clear financial goals, such as paying off debt, building an emergency fund, or saving for a specific purchase. Having a purpose for your money can motivate responsible spending.

Allocate Funds

Allocate specific amounts to different spending categories, including necessities, savings, and discretionary spending. Be sure to leave room for occasional indulgences.

Use Cash or Debit

Consider using cash or a debit card for daily expenses, as it can make you more mindful of your spending. Leave your credit cards at home to reduce the temptation of impulse purchases.

2. Identify and Manage Triggers

Compulsive spending often has emotional triggers. Recognizing and managing these triggers is essential:

Keep a Journal

Maintain a journal to track your spending habits and the emotions associated with each purchase. This can help you identify patterns and gain insights into your behavior.

Practice Mindfulness

Develop mindfulness techniques to become more aware of your emotions and impulses. Before making impulsive purchases, pause, take a deep breath, and consider whether the purchase aligns with your goals.

Seek Professional Help

If emotional triggers seem overwhelming, consider seeking support from a therapist or counselor specializing in addiction or compulsive behavior. They can provide valuable strategies and coping mechanisms.

3. Remove Temptation to help with impulse control

Making it more difficult to shop impulsively can be a game-changer:

Unsubscribe

Unsubscribe from marketing emails and newsletters that tempt you to shop. Clicking that “unsubscribe” button can save you from countless impulse purchases.

Limit Access

Delete shopping apps from your devices and remove your stored payment information from online stores. Creating barriers to spending can give you time to reconsider purchases.

Set Limits

Establish clear spending limits for yourself and stick to them. If you reach your limit for a particular category, don’t make additional purchases until the next budget cycle.

4. Find Healthy Alternatives

Replace compulsive spending with healthier coping mechanisms:

Cope with Stress

Explore stress-relief techniques such as meditation, exercise, or pursuing hobbies to channel your emotions positively. Engaging in activities you enjoy can be a fulfilling alternative to shopping.

Connect with Supportive People

Share your struggles with trusted friends or family members who can provide emotional support and encouragement. Sometimes, talking openly about your challenges can alleviate the urge to shop.

Join a Support Group

Consider joining a support group for compulsive shoppers. Sharing experiences and strategies with others facing similar challenges can be empowering. It reminds you that you’re not alone on this journey.

5. Seek Professional Help When Needed

Don’t hesitate to seek professional assistance if compulsive spending is significantly impacting your life:

Therapy

Cognitive-behavioral therapy (CBT) and other therapeutic approaches can address the underlying causes of compulsive spending and provide strategies for change. A qualified therapist can help you develop healthier spending habits and cope with emotional triggers.

Financial Advisor

Consult a financial advisor who specializes in helping individuals overcome debt and improve financial management. They can assist in creating a customized financial plan tailored to your needs and goals.

Embrace the Journey to Financial Freedom

being able to stop compulsive shopping is a journey, not a destination.

Be patient with yourself and celebrate small victories along the way. Changing behavior takes time, but with determination and these actionable tips, you can break free from these debilatating habits and enjoy the financial freedom you deserve.

Remember, you’re not alone, and there is support available to help you on your path to a healthier relationship with money. Embrace this journey toward financial freedom, and with each step, you’ll move closer to a brighter and more financially secure future.

Continuing on this path to financial freedom means acknowledging that change is not an overnight transformation but a series of steps and choices. Here are some additional insights and tips to guide you along your journey:

6. Embrace a Minimalist Lifestyle to Help Control Your Spending

Adopting a minimalist lifestyle can be a powerful antidote to compulsively distracting yourself with shopping. Minimalism encourages you to prioritize experiences and meaningful relationships over material possessions. Consider decluttering your living space and simplifying your surroundings. As you declutter, you may also discover items you can sell, putting extra cash toward your financial goals.

7. Reward Yourself in Non-Material Ways

Shift your focus from buying things to rewarding yourself in non-material ways. When you achieve a financial milestone or resist an impulse purchase successfully, treat yourself to experiences like a day outdoors, a favorite hobby, or quality time with loved ones. These rewards can be just as satisfying as material possessions, if not more so.

8. Stay Informed and Educated about Addiction

Knowledge is a powerful tool on your journey to overcome compulsive behaviour. Educate yourself about personal finance, budgeting, and investment strategies. The more you understand your financial situation, the more empowered you’ll be to make informed decisions that align with your goals.

9. Monitor Your Progress

Regularly review your financial progress and celebrate your achievements. Track your savings, debt reduction, and improved spending habits. Celebrate even small victories, as they contribute to building your confidence and commitment to change.

10. Cultivate Patience and Self-Compassion

Breaking free from this addiction may involve occasional setbacks. Understand that relapses can happen, and it’s essential to treat yourself with compassion when they do. Instead of dwelling on mistakes, focus on what you’ve learned and how you can continue to improve.

11. Share Your Successes and Challenges

Share your journey with trusted friends or family members who can offer encouragement and support. Having an accountability partner can help you stay committed to your goals. Consider discussing your progress, challenges, and strategies for resisting the urge to go shopping and buy something with someone you trust.

12. Seek Professional Financial Guidance

If you’re struggling with significant debt resulting from your struggle with compulsive shopping, consider reaching out to a credit counselor or debt management program. They can work with you to create a structured plan for paying off debt and regaining control over your finances.

13. Give Back to Others

Engaging in acts of kindness and giving back to the community can provide a sense of fulfillment that goes beyond material possessions. Volunteer your time or resources to causes that resonate with you. Contributing to the well-being of others can shift your perspective on what truly matters in life.

14. Stay Mindful and Stay Committed

Remember that overcoming compulsive spending is an ongoing process. Stay mindful of your goals and continue practicing self-awareness. By staying committed to change and consistently applying the strategies you’ve learned, you’ll gradually reshape your relationship with money.

15. Celebrate Your Financial Freedom

As you progress on your journey, you’ll notice positive changes not only in your financial situation but also in your overall well-being. The sense of accomplishment that comes from conquering compulsive shopping disorder and gaining control over your finances is a remarkable achievement. Celebrate this newfound financial freedom with pride.

Final Thoughts

Breaking free from this condition is a significant achievement that requires dedication, self-reflection, and resilience. While the path may have its challenges, each step forward brings you closer to a life of financial security, peace of mind, and a healthier relationship with money.

Embrace this journey as an opportunity for personal growth and transformation. By applying the strategies, seeking support when needed, and staying focused on your goals, you can overcome this consistant need to spend money and unlock a brighter financial future filled with possibilities. Your financial freedom awaits, and you have the strength to reach it.

How to Stop Compulsive Shopping Read More »